Here is a post about reserve banks are stacking into gold. If you desired to read the initial post you can find link at the end of this post.

Summary

Figure 5 – Source: tradingeconomics.com The above is by no suggests a total list of main banks buying gold. We have actually also seen nations like Jordan, Mongolia and Egypt increasing their holdings over the last few year.

Lots of nations have been buying gold recently, which might be the factor for why gold is holding up fairly well. That associates with both to the consistent buyers, however brand-new countries are also taking benefit of the lower cost.

Belief & & Yields The managed cash long and brief positioning turned extreme during August of 2018. Ever since, we have seen the positioning stay flat. The placing often swings hugely over time which indicates we might be taking a look at changes one method or the other relatively soon.

Figure 4 – Source: goldindustrygroup.com.au Up up until 2008 we saw main bank gold reserves decline, primarily driven by selling from reserve bank in the industrialized world. Given that 2008 we have actually seen couple of nations selling, but the bulk of purchasing comes from a handful of countries.

Government Debt as a % of GDP Figure 6 & & 7 – Source: data.oecd.org At the exact same time as we have actually seen the take advantage of go up, we have likewise seen the long-term rates of interest decrease across a lot of countries.

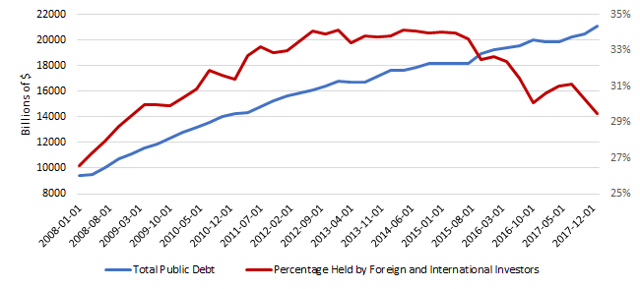

Long-Term Interest Rates Figure 8 – Source: data.oecd.org As gone over previously, we have actually seen the U.S rates of interest increase over the last couple of years. That has actually nevertheless not swayed central banks or global investor to increase their holdings of treasuries. The below chart highlights the increasing government debt in the U.S. and the portion of bonds held by global and foreign investors.

Investment Thesis

The long-lasting yields in the U.S. appears to have broken important pattern levels. However, gold (GLD) remains above $1,200/ oz in spite of the greater real return on long-dated bonds and the extremely bearish belief in the paper gold market.

Figure 3 – Source: twitter.com Reserve Bank Gold Buying The listed below chart is an excellent illustration of main bank purchasing of physical gold over the last 20 years.

Up till 2008 we saw main bank gold reserves decline, primarily driven by selling from central bank in the industrialized world. The above is by no means a total list of central banks buying gold. The factor for why foreign main banks is increasing their gold holdings are certainly up for argument. Central banks across the world are buying gold and appear less ready to fund the growing U.S. debt.

Russia and Kazakhstan have corresponded buyers over the last decade. Whereas India, Mexico and Turkey have been buying more occasionally. We likewise have China which is releasing the data more sporadically.

COMEX Gold Combined Managed Money Long Positions information by YCharts Figure 1- Source: YCharts Figure 2 – Source: tradingview.com The U.S. 10-year yield now stands at 3.23% and the 30-year yield at 3.40%. These levels have actually been pointed out by lots of to indicate a clear trend-break and the truth that we ought to expect greater yields going forward, Jeff Gundlach being among them. If this was truly a sign of economic strength, wouldnt gold have decreased substantially on this news? The chart clearly shows that isnt the case. Which implies the rate walkings might a minimum of partially be a concern over the financial obligation and deficit. The listed below photo might be excessively harsh, however hold some reality and too amusing not to include from Pinecone Macro on twitter.

Figure 9 – Source: fred.stlouisfed.org Conclusion Main banks across the world are buying gold and seem less ready to fund the growing U.S. debt. While treasuries may look more attractive than a number of years earlier. The rate of return is still too low provided the increased utilize if you zoom out.

Gold may continue to decline in the short-term if U.S. yields continues to increase, however I believe gold is a far much safer investment in the long-run compared to the majority of federal government bonds given the leverage.

Did you like this short article? Please consider giving me a “Follow” by clicking the button above or take a look at a few of my other current short articles. Share your concerns or remarks.

Disclosure: I am/we are long GLD.

I wrote this post myself, and it reveals my own viewpoints. I am not getting settlement for it (besides from Seeking Alpha). I have no organisation relationship with any business whose stock is mentioned in this article.

We found this great short article at https://seekingalpha.com/article/4210296-central-banks-piling-gold By: Bang For The Buck and thought it would be beneficial to our customers.

The more consistent central bank buyers are not deterred by the decline in the gold cost but are continuing to buy.

We are likewise seeing several brand-new countries purchasing for the very first time in a very long time.

The belief is still extremely negative in the gold paper market.

The price of gold has actually held up well over the last week regardless of the fast increase in U.S. long-term yields.

The below chart is a great illustration of main bank purchasing of physical gold over the last 2 years.

More recently we also saw Poland purchasing gold, making it the very first EU member to do so considering that 1998. Which can be viewed as a rather substantial vote of no self-confidence on the present expansive monetary policies.

Financial obligations & & Yield The factor for why foreign main banks is increasing their gold holdings are certainly up for dispute. If we look at the government financial obligation as a portion of GDP in the 35 country OECD database. We see a really comparable pattern where the total utilize has actually increased significantly in the last decade. Some countries are more extreme, however this pattern is clearly reflected in the average and median also.