The PMI for China s producing division can be found in at a weaker 50.3, representing a 8 month low, which included additional pressure to the Asian markets.

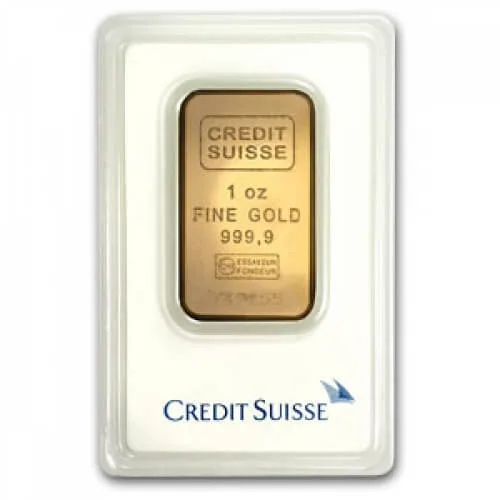

Gold costs came back and skyrocketed after they handled to hit a 5 week high. This comes as a surprise because it was just over night that they managed to strike a three day low. The trading variety for gold was said to be the biggest spread in years, with various elements contributing to the total gains. There was a big amount of short-covering in the market, buy stop orders being triggered due to price thresholds being hit, and people searching for bargains on the money market. With the quick modifications in the oil prices followed up by a weaker U.S. dollar, the marketplace is perfectly set for a large dive in overall gold prices. Silver prices also handled to strike a large price rebound. Gold finally settled at $1,217.40 after the day started.

There was a large quantity of short-covering in the market, purchase stop orders being triggered due to rate limits being struck, and people looking for deals on the money market. With the quick changes in the oil prices followed up by a weaker U.S. dollar, the market is completely set for a large dive in general gold rates. Silver rates likewise managed to hit a big cost rebound. The world stock markets were likewise under a lot of pressure on Monday after what is being viewed as a collapse on Friday of unrefined costs. This had the costs better to the session high, suggesting that the bears were not able to keep it together at the lower cost levels, but this did not come as a surprise for anyone within the market.

As soon as again to an overall level of 5%, Russias ruble currency has sunk versus the U.S. dollar. The outcome of this was Russias reserve bank acting to supply a slight stimulus to serve as security for the marketplace. The dollar is still near a 4 year high.

Gold futures wound up closing near the session high, providing the bulls an upward momentum that has not been seen for a number of months. However, bears have managed to keep the short-term benefit in the market a minimum of. The Wycloffs Market ranking had the ability to hover at a solid 3.0.

The silver futures market was likewise looking much healthier despite finishing at a 5 year low. The bulls still had the momentum to act due to the negation of the four month downward pattern on the everyday bar charts. In general, the Wycloffs Market Rating held stable at 3.0.

Another location of the gold market that had some people biting their nails with anticipation was the Swiss referendum that would have increased the Swiss banks gold holdings by 20%. Individuals voted this procedure down which served to keep the gold market on its rise in cost.

Copper metal managed to get 555 points and came to the cost of 290.15 cents on the day. This had the rates closer to the session high, indicating that the bears were unable to keep it together at the lower price levels, however this did not come as a surprise for anybody within the market. They ended up with a weaker Wycloffs Market Rating of 1.5.

The Euro Zones buying managers index was ranked at 50.1 in November, down from 50.6 in October. Given that there is an expectation of financial contraction at anything below 50.0, the European Central Bank is anticipated to act in order to supply a stimulus to assist the European Union economy. This move is anticipated to happen at the next meeting.

Asian financiers were some of the first to start buying gold as a way to get some safe haven trades in before there was another big modification in rates. This began the heels of news that Japans credit ranking had been reduced by Moodys.

The world stock markets were also under a load of pressure on Monday after what is being considered as a collapse on Friday of unrefined costs. Crude rates handled to sink as low as 463 a barrel in the overnight trading. This deeply impacted the trading market and stimulated various forms of commodity trading to exist.