The metals in general have been peaceful and are the tale of two cities– gold on top end and must go lower, and silver at the bottom end and must go higher. The ratio in between the two is 87-1, making a gold sell-off and a silver rally a genuine possibility. For now, the very best trade is the among observation.

Here is a short article about gold and silver prices update. , if you wnat to check out the original post you can discover the link at the end of this post.

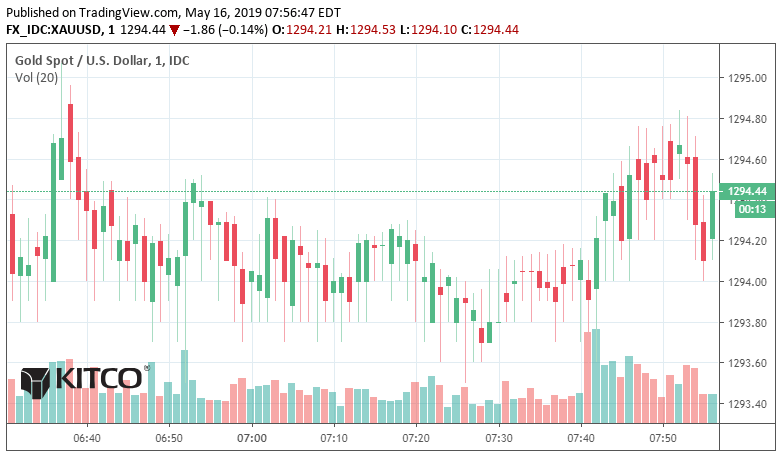

Another day, another failure for gold to break out to the benefit, which follows the marketplace footprint. It was just recently when the gold bulls were chirping, and the purchasers could not get enough. Gold traded as high as $1,304, yet here it sits in the $1,290 s.

Where this great short article at https://www.kitco.com/commentaries/2019-05-16/Gold-Silver-Getting-Ready-To-Move.html By: Todd Bubba Horwitz and believed it would be really helpful to our subscribers.

.

Silver stays on a respirator. With the recent volume and volatility, the markets might be closed and nobody would know the difference. Silver will break out of this range and will go up huge or down big. Based upon the pattern, the chances prefer up however there are no guarantees.