From the time of ancient civilizations to the modern age, gold has been the world’s currency of option. Today, investors purchase gold generally as a hedge against political discontent and inflation. In addition, lots of top investment consultants recommend a portfolio allocation in commodities, including gold, in order to lower general portfolio risk.

We’ll cover much of the chances for buying gold, consisting of bullion (i.e. gold bars), mutual funds, futures, mining business, and jewelry. With few exceptions, only bullion, futures, and a handful of specialized funds offer a direct investment opportunity in gold. Other financial investments derive part of their worth from other sources.

Purchasing physical gold (bars and coins).

Small bars and coins accounted for approximately two-thirds of yearly financial investment gold demand and around one quarter of worldwide gold demand over the past decade. Need for bars and coins has actually quadrupled because the early 2000s, and the pattern covers both the East and the West. New markets, like China, have actually been established and old markets, like Europe, have actually reemerged.

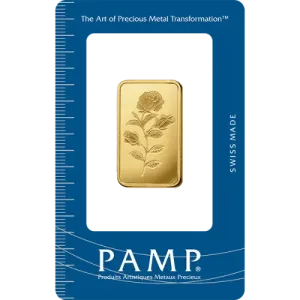

- Bars been available in amounts between one gram (around 1/31 of an ounce) and 400 ounces. They have a lower markup due to the fact that there’s no minting included. Rich financiers buy bigger bars when they do not want to hold a great deal of coins.

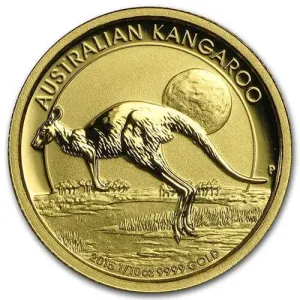

- Coins have the advantage of being both recognizable and portable. That will usually make them simpler to offer to a personal celebration. The most typical bullion coins are the American Eagle, Canadian Maple Leaf, and South African Krugerrand, however, of these three, just the Maple Leaf is pure gold. And there are many other coins readily available.

- They’re offered in one-tenth, one-quarter, one-half, and one-ounce coins. But be aware that the lower denominations cost more on a per-ounce basis than one-ounce coins. Some coins may be alloyed with other metals. However each one-ounce coin consists of a full ounce of gold.

Mining stocks

A more indirect method to buy gold is by means of mining companies. You can buy mining company stocks or a mutual fund or ETF that concentrates on business that mine precious metals. (Although gold is possibly the most typical financial investment metal, silver, platinum and other metals provide similar chances).

Purchase Gold ETFs

Gold ETFs If exchange-traded funds (ETFs) are the most convenient method to invest in stocks, the exact same can be said for gold. Just like a stock-based ETF, gold ETF represents physical gold in which you buy shares.

They can be traded like stocks and have the advantage that a lot of significant financial investment brokers have actually waived their trading charges on ETFs. And considering that it transforms a physical possession into a paper one, it can easily be held in your portfolio together with other properties.

ETFs are the best method for a novice to purchase gold. They can be bought and sold through the majority of major financial investment brokerages, such as E * TRADE, which is one of our favorites. A gold ETF has the advantage of having indirect ownership of physical gold, which is less risky than other choices.

The biggest gold ETFs are SPDR Gold Shares (GLD) and iShares Gold Trust (IAU), though there are others.

If you are thinking of buying gold in NYC visit https://bulliontradingllc.com