This need to look really enticing for contrarians as it remains in record short area and any bounce would activate a short capture. The red line, which represents the net speculative positions of cash supervisors, revealed the speculative position decreasing to a record level.

The average fuel to produce an ounce of gold is 32 gallons as versus 0.50 gallons for silver. This has to do with 64 to 1 of fuel usage for production of an ounce of gold and silver.

.

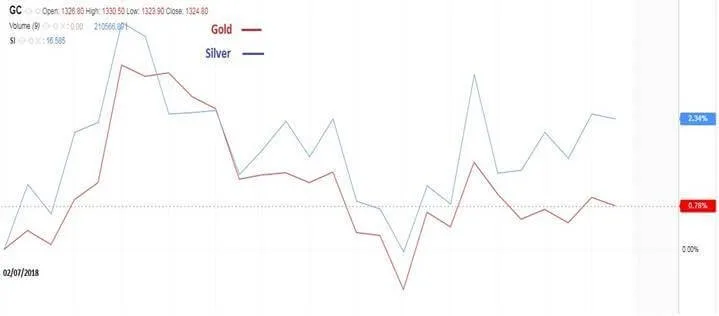

The following chart reveals that in current times, silver has beaten gold. This is uncommon as silver tends to have a greater beta than gold and tends to drop far more than the yellow metal on down weeks. These are extremely great signs for silver bulls.

In 2017, the average expense of silver production is $14-15/ oz. The following chart shows that in current times, silver has actually beaten gold.

We found this nice article at https://economictimes.indiatimes.com/markets/commodities/views/silver-prices-may-break-the-december-jinx-with-a-take-off/articleshow/63365506.cms By: Aasif Hirani and thought it would it would be really practical to our silver investor customers.

The typical mining gold-silver ratio has to do with 1 to 9, which makes silver undervalued compared to gold.

Nevertheless, production expenditures are expected to bump up as fuel constitutes among the main expenses of mining gold and silver. With a dive in petroleum price, we can anticipate an additional hike in production cost that will make silver more undervalued if the ratio remains near 78-80.

This might give you a sensation of deja vu. In December when gold-silver ratio came in at 80, we did forecast that latter would outshine the former looking at the previous history. Silver did beat gold, but just for a brief spell when the ratio fell to 76.65 from 80, however has actually again climbed up back to the 80 mark.

Here a great article about silver will increase this coming December 2018. , if you desire to check out the original material there is a link at the bottom of this post.

When again, we are forecasting that silver ought to see a rally from here onwards. All the best active ingredients for a take-off are already there and we are hoping that we hear the announcement of the flight taking off. We already have actually attached our se.

The current gold-silver ratio, at around 80, is near the historic high of 2008 when the reading was 84.90. The price of silver blew up from there and by 2010, the ratio had reached to 64. When the ratio nears 80, a historical chart analysis reveals that silver constantly acquires versus gold.

There is a difference this time. The outperformance of silver versus gold must hold for a longer period, going on.

The price of silver exploded from there and by 2010, the ratio had actually reached to 64. A historical chart analysis shows that silver always acquires versus gold when the ratio nears 80.

In 2017, the typical cost of silver production is $14-15/ oz. The matching figure for gold is around $1,100-1,150. The production cost ratio is around 76. Which is why we are seeing the cost ratio reversing from 76.

The other reason that I feel silver is prime for breakout compare to gold is the COT (Commitment of Traders) report. Silver speculators increased their own COT net-short position to the greatest on record.

Silver did beat gold, but just for a short spell when the ratio fell to 76.65 from 80, but has once again climbed up back to the 80 mark.