Here is a short article about methods to hold gold as a safe house investment. If you want to check out the original post you can find the link at the bottom.

Soaring rates likewise triggered The Royal Mint to announce its objective to introduce a gold-backed exchange traded commodity (ETC) in action to increasing need from financiers. The brand-new ETC will allow savers to purchase the yellow metal without having to buy physical gold.

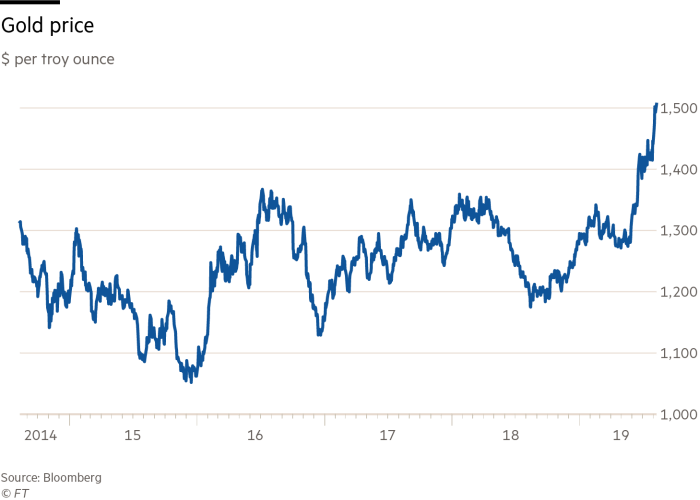

Gold caught financiers attention again this week as professionals forecasted its rate could soar to highs of $2,000 an ounce within the next two years. In a research study note, Citigroup analysts said slowing global development and potential rate of interest cuts in the US might drive the gold rate up, as investors seek to minimize risk.

Adrian Lowcock, head of individual investing at Willis Owen, stated golds capability to function as a shop of worth was attractive. He alerted that in the brief term the gold cost has actually ended up being more prone to speculators and added: “The rate is arguably more unstable as investors can more quickly move in and out of the asset class.”

Mr Lowcock recommended investors need to hold no more than 5 percent of their portfolio in gold. “It is an asset class different from any other and serves as an outstanding method to diversify your portfolio in addition to an insurance plan to safeguard your wealth,” he said.

The cost of gold has actually increased by 18 per cent this year, reaching more than $1,550 an ounce this month for the very first time since April 2013.

Gold is a non-yielding possession, it is viewed as a safe harbour for investors amid collecting market storms stated Vincent Ropers, portfolio manager of the TB Wise multi-asset growth fund. “It is a timeless inflation hedge. In times of economic unpredictability, gold is thought about invulnerable to the actions of centralised institutions.”

Specialists likewise see gold as a great diversifier and enduring shop of worth. This is due to the fact that the cost of gold tends to move in a various direction from other possessions such as equities.

Worries that trade stress in between the United States and China might cause a global decline, continuing discontent in the Middle East and continuing unpredictability around the UKs Brexit settlements have all provided the valuable metal an increase.

He added: “In the event of a potential decline we are positive that gold will perform highly, particularly as the policy response will probably include zero or unfavorable rates, more cash printing and fiscal expansion that will lead to the market questioning expectations of long-lasting low inflation.”

Robin McDonald, head of multi manager investments at Schroders, stated: “Were pretty bullish about gold on a 12-18 month view, believing that it has a decent opportunity of helping diversify a well balanced portfolio in manner ins which bonds have a hard time to do with such low yields.”

” For countless years, gold has actually been identified worldwide as the ultimate means of trading and storing wealth,” said Anne Jessopp, chief executive of the Royal Mint.

Having actually weighed up the dangers, there are a number of ways for financiers to hold gold:

Exchange traded commodities track the area rate of gold and work in the same way as tracker funds, replicating the ups and downs of the gold rate. It is possible to sell and purchase gold by means of online trading platforms such as bullionvault.com, which will match financial investments with physical gold bullion held in vaults.

Investors should also know that such funds do not entirely invest in gold miners and tend to have exposure to other rare-earth elements. Similarly, gold miners are unlikely to be exclusively associated with mining gold, and will produce other resources. There is no guarantee that their share prices, or the cost of fund systems, will replicate gold rate movements.

Those prepared to handle more risk might think about investing directly in shares in gold miners. Performance tends to be volatile and revenues will depend not only on the cost of gold and the amount produced, but likewise the expense of production.

Given the unpredictability of the sector, another alternative might be considering a more diversified fund of gold miners, such as BlackRocks Gold & & General fund or the JPM Natural Resources fund. Funds use greater diversity as they purchase a portfolio of gold mining companies picked by fund managers– indicating they likewise have continuous charges, generally around 1 per cent.

Think about gold funds.

Invest straight in gold shares.

Exchange traded products track the spot price of gold and work in the exact same way as tracker funds, replicating the ups and downs of the gold cost. They can be traded at any time when markets are open, and numerous can be held within Isas and Sipps. There is typically a broker commission to pay on their purchase and sales and a yearly charge of about 0.5 percent, but no stamp task or initial charge.

Danny Cox, chartered financial planner at Hargreaves Lansdown, stated 2 elements that set investing in gold miners apart from ETCs were the potential for gold price-beating returns, and dividends. Gold miners are unlikely to be entirely included in mining gold, and will produce other resources. There is no warranty that their share prices, or the rate of fund units, will replicate gold cost movements.

Purchase physical gold.

Invest in exchange traded products (ETCs).

Peter Sleep, senior investment manager at Seven Investment Management, is not a huge fan of gold in the current climate but said that for those who wish to invest in the rare-earth element, by far the easiest method is to purchase a gold ETC. “We own a percentage of the Invesco Physical Gold ETC, which costs 0.24 per cent,” he said.

Danny Cox, chartered monetary coordinator at Hargreaves Lansdown, said 2 aspects that set investing in gold miners apart from ETCs were the capacity for gold price-beating returns, and dividends. When gold rates are low, some miners will have a hard time,” he said.

Investors can purchase the genuine thing in the type of gold coins, which are extensively readily available, or bullion bars, which are a bit harder to purchase. Financiers require to consider the expense of security and storage, delivery and insurance coverage charges. It is possible to offer and buy gold via online trading platforms such as bullionvault.com, which will match financial investments with physical gold bullion held in vaults.

We discovered this great short article at https://www.ft.com/content/67c79e38-d3db-11e9-8367-807ebd53ab77 and believed it would be helpful to our fans.