We might be saved from those conditions by a fourth quarter touchdown pass from specific potential newly-revived sectors of the economy, but evidence is accumulating that recommends we may be headed toward a repeat of the 70s.

Bullion Trading, LLC.

When the market is in program 1, history and mathematics determine real estate to be a most likely performer. When that program changed, you d ditch genuine estate to some degree.

At present, the marketplaces performance is indicative of high growth/low inflation. Were gradually paced, it would appear, to go into a stage of low growth/high inflation, which is knocking on the door of stagflation.

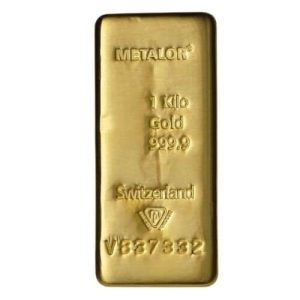

Joblessness is down, however GDP isnt skyrocketing at a commensurate rate. This is a great environment for gold and physical products, due to the fact that theres truly just one location to go from here– up.

.

Theres high growth/high inflation– thats genuine estate and natural resources. Thats all to state gold is positioned to make its move into the spotlight as soon as again very quickly. The conditions were about to take on are, historically, some of golds favorite. There will of course be changes, however the general direction for gold over the next few years is up.

With the rates adjusted and high inflation on the horizon, bonds might not fare so well (for the time being).

In other words, when market conditions change, so do the rules for enduring that market.

If you need to buy gold for your portfolio, do so now.

Examine out our previous short article about Recent Higher Interest Rates and What it Means to Investors.

Understanding where our economy is regime-wise is never especially hard. Playing by the rules of the day and investing the proper way at the right time is trickier. When one routine, or season, modifications, and another rolls in, youve got to adjust your portfolio appropriately.

Europe and China are both slowing down financially. Copper, iron, the majority of the metals, and oil have all taken a bit of a dive thanks to Brexit, many independance memorandums, and a worldwide rise of nationalistic worths, to name a few things.

The majority of want to state its as basic as “purchase low, sell high,” but our world is clearly more complicated than that. Weve discussed before that markets go through season-esque changes like the weather does. The best principles by which to invest change with the markets, and there are (broadly speaking) four environments or programs were used to seeing in modern-day investing.

Not too hard, best? When the light is green, go.

The rise of oil rates in the 1970s proved to be the significant contributing aspect to stagflation, and saw a duration of years where gold was among the only financial investments that valued in any significant method.

Recently, the Fed raised their rate of interest. This signals their alleged confidence in the growing U.S. economy, and it definitely indicated a program change.

Do so now if you require to purchase gold for your portfolio. If you desire to sell, its finest you hang onto your items for a few more years. Itll deserve a lot more then.

In the 1970s, the U.S. economy (and by extension, the gold market) saw conditions that let to a relatively unusual series of occasions, collectively referred to as “stagflation.” The term explains a financial investment program comprised of inflation and financial stagnancy.

Once again very soon, thats all to say gold is positioned to make its move into the spotlight. The conditions were about to handle are, historically, some of golds favorite. There will of course be variations, however the overall instructions for gold over the next couple of years is up.

Theres high growth/high inflation– thats genuine estate and natural resources. Then theres high growth/low inflation, which is where stocks are most comfy. Low growth/low inflation is when bonds become the hot commodity, and low growth/high inflation is what we in the gold market prefer to see.