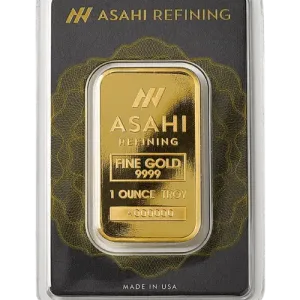

Up until the election, The U.S. presidential race has been more of a distraction than a direct influence on the gold market but going forward expect the precious metal to be a winner no matter the outcome.

For gold, the election isn’t a “blue versus red” competition between the Democrats and Republicans, says Frank Holmes, chief executive officer of U.S. Global Investors. It is a “push the gold button” event, he says.

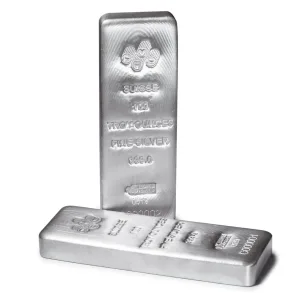

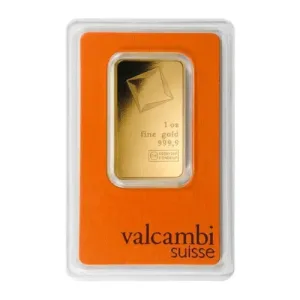

Let me explain in simple terms why gold is a buy no matter who wins. First there are a few things that you need to understand. Gold is priced all over the world in U.S. Dollars. Therefore, if anyone outside of the United States is considering buying gold they must first convert their currency into the US dollar & only then can they buy gold. What this means is that as the value of the dollar goes down the price of gold goes up & if the value of the dollar goes up the price of gold will go down.

It doesn’t make a difference who will win the election as both parties have stated that the first thing on the agenda to add stimulus to the economy. No matter how they do it the one thing is for sure is that they will end up printing dollars. The result of printing dollars is that the value of the dollar goes down thereby increasing the value of gold.

People are asking me the whole time as to why the stock market is going up & in my opinion it is rather simple. It is going up also because the gov’t is printing dollars & companies & people that have these dollars would rather put it into some investment rather then to just hold it in a bank account. This too causes a race for people to buy things as they can only expect for things to cost more going forward. This will be another benefit to the price of gold as inflation causes the price of gold to increase.