While increasing gold prices need to be good news for gold stocks, it may be even much better news for silver stocks.

Here is exceptional material relating to Silver Stocks. , if you have any concerns about the article or you would like to see the initial post the link to it is at the end.

There has actually likewise been no reason for financiers to offer gold despite the Federal Reserves tightening up of financial policy. Even with the Fed having actually raised its federal funds target rate by an aggregate of 1% considering that December 2015, yields on interest-bearing possessions have not moved much higher. Typically, a rising-rate environment is bad for gold, because gold has no yield. However, if yields on interest-bearing possessions remain listed below the nationwide inflation rate, the opportunity cost of owning gold will remain low.

The unexpected beneficiary of golds current surge

On the surface area, the recent upside in spot gold would realistically imply good ideas for gold stocks. As long as exploratory and continuous mining expenses arent increasing at a quicker speed than area gold, higher margins ought to be possible throughout the gold-mining market. However, its silver stocks that might wind up being the biggest beneficiary, for 2 key factors.

All set or not, here comes the gold market completely rally mode. Since the beginning of the year, spot gold prices have jumped by nearly 16%, and theyre higher by much better than 18% since touching a 52-week low of $1,128 an ounce back in December 2016.

Explaining golds recent ascent

A confluence of elements have come together to provide the glossy yellow metal a lift. At the top of the list, at least in the short term, has been rising levels of uncertainty.

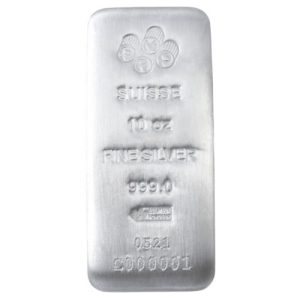

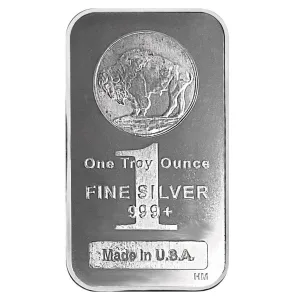

Throughout the 20th century, this ratio balanced about 47-to-1. For financiers, it suggests that the best course of action is to purchase silver or silver stocks when this ratio is substantially higher than 47-to-1, and to purchase gold or gold stocks when it dips noticeably below the historic average. At nearly 75-to-1 today, the ratio would recommend that silver might have an opportunity to exceed gold, although both metals have space to run higher.

.

If the gold-to-silver ratio is at the leading edge of financiers minds, then First Majestic Silver(NYSE: AG) would be among the biggest recipients. Among all silver stocks, none has more of their production dedicated to silver (roughly 70% of total sales) than First Majestic Silver, at least according to early-year production estimates from the Bank of Montreal. Reinvestment in existing and brand-new mine development is anticipated to yield in the neighborhood of 20 million silver ounces of production annually by the end of the years, which would be up perfectly from the 11.9 million ounces of silver produced in 2016.

Gold and the dollar normally move in opposite instructions, suggesting the dollars discomfort has actually been golds gain.

A great example is SSR Mining ( NASDAQ: SSRM), which recently changed its name from Silver Standard Resources to show its shift in production. The company recently signed a joint venture with Golden Arrow for the Chinchillas Project, bringing in a new source of silver production by the 2nd half of 2018 as its old source dries up, SSR Mining will still stay heavily influenced by gold in the meantime.

Do not forget the gold-to-silver ratio

The other driver here is that an increase in golds spot cost might broaden the gold-to-silver ratio, which simply describes how lots of ounces of silver it would take to equal the rate of 1 ounce of gold. As of the close for both metals on Sept. 6, 2017, it would take 74.8 ounces of silver to equal the cost of an ounce of gold.

Weakness in the U.S. dollar has also been a major favorable for gold rates. Gold and the dollar normally move in opposite instructions, meaning the dollars discomfort has been golds gain.

This unpredictability is a breeding ground for financiers creativities, and its the perfect reason for some financiers to seek the security that gold is perceived to provide.

This is a great and remarkable post we discovered at https://www.fool.com/investing/2017/09/11/surprise-silver-stocks-may-be-the-biggest-benefici.aspx by: Sean Williams and thought this was something that our customers may discover extremely useful.

Generally, a rising-rate environment is bad for gold, given that gold has no yield. On the surface, the current benefit in area gold would logically mean excellent things for gold stocks. For financiers, it recommends that the finest course of action is to buy silver or silver stocks when this ratio is significantly higher than 47-to-1, and to buy gold or gold stocks when it dips significantly below the historical average. At almost 75-to-1 right now, the ratio would suggest that silver might have an opportunity to outshine gold, although both metals have room to run greater.

To begin with, most silver stocks have actually diversified their production portfolios in the last few years as an outcome of area silvers volatility. This diversity has actually led numerous to lower their exposure to silver and increase their direct exposure to gold, therefore lowering recognized price volatility on what they sell.