Here is a good post about methods to buy gold and silver. This is not our initial article so we have actually consisted of a link to the initial author at the end of this post. We hope you discover it helpful.

It is not made complex.

The majority of investors comprehend that gold plays a valuable role in a sound financial investment portfolio, however, unless you are already a gold financier you likely do not understand of finest methods to invest in gold.

Main banks worldwide are buying gold in near-record amounts to shore up their financial positions before the next crisis takes place.

Below are a few ways that financiers can invest in gold, in addition to their cons and pros, as follows:

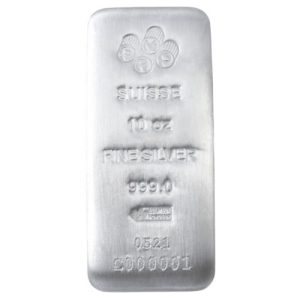

Physical Gold

ETFs have ended up being an incredibly popular investing method over the past years. They provide financiers the opportunity to gain direct exposure to a variety of financial investment assets, specifically commodities, without having to acquire the properties themselves.

In the case of gold ETFs, the fund holds gold and issues shares in that gold to financiers. The value of the shares is supposed to track the value of gold. The major advantage to ETFs is that the shares are extremely liquid and have the ability to be bought and offered on a variety of different exchanges.

Owning gold in a gold IRA suggests that financiers actually own physical gold that is held by a certified custodian in a vault, and that gold is insured. Investors select which bars or coins they want to own, and they own exactly those coins or bars, not just shares in a swimming pool of gold.

While the decision on how to purchase gold is eventually an individual option that financiers will need to pick their own, the important thing is to begin buying gold now prior to gold rates rising higher, and stock markets crashing.

When you require it, the advantage of holding physical gold is that it is readily available. If you find yourself with a sudden need for cash you can take your coins to the nearest coin dealer, metal broker, pawn shop, or online market to sell your coins.

Financiers who held gold throughout the last monetary crisis came out method ahead. Financiers who diversify into gold prior to the next monetary crisis will find the same protection.

For years the only method to invest in gold was to hold physical gold. In the case of gold ETFs, the fund holds gold and issues shares in that gold to financiers. Gold ETFs also do not allow investors to take physical belongings or ownership of any underlying gold. The biggest gold ETF isSPDR Gold Shares (GLD).

There is insurance. Theft of your gold from your home is a genuine possibility. You would need to be responsible for any insurance to make yourself whole in case of such an event.

The significant downsides to owning physical gold are storage and insurance. You could keep your gold at home, which would usually require purchasing some sort of safe. Or you might save the gold in a safe deposit box in a bank.

Due to the fact that of the tax advantages of a gold IRA, the security of storing gold with an insured custodian, and the capability to take physical delivery if the financier desires, a gold IRA provides the very best of all possible worlds.

That would mean that your access to your gold is dependent on your bank’s openness. Outside banking hours you can forget being able to get to your gold. And on the occasion of a bank vacation, a bank failure, or a government-mandated search of bank deposit box assets, you’re at risk of losing your gold.

Exchange-Traded Funds (ETFs).

Gold IRAs.

You can discover the original post here https://www.livetradingnews.com/there-is-more-than-1-way-to-buy-gold-and-silver-154037.html By Paul Ebeling.

Like conventional IRAs, gold IRAs allow investors to buy gold with pre-tax dollars and hold that gold tax-free up until it comes time for circulation.

For decades the only way to purchase gold was to hold physical gold. The majority of people indicated owning gold coins. In recent years high-quality gold bullion bars have actually appeared for private financiers in a range of different sizes.

Gold ETFs likewise do not enable investors to take physical belongings or ownership of any underlying gold. So if there ever comes a time when you wish to take physical possession of gold, you can not. The largest gold ETF isSPDR Gold Shares (GLD).

And then there are gold IRAs. Like traditional IRAs, gold IRAs enable financiers to purchase gold with pre-tax dollars and hold that gold tax-free till it comes time for circulation. When financiers choose to take a circulation they can either take it in cash or in gold.

The disadvantage to ETFs is that investors do not in fact know if the fund owns as much gold as it states it does, nor do they know the specific relationship between the variety of outstanding shares and the quantity of gold held. That is the Big Q when it comes to “paper gold.”.