You and your partner can individually offer a gift amounting to $14,000 per year to the exact same recipient, which implies the individual can take pleasure in a tax-free gift totaling to $28,000. You can end up owing present tax of up to 40% if you go over the basic exemption limit.

This year 2015, the Internal Revenue Service has raised the life time gift-tax exemption, also called fundamental exemption, from $5.34 million in 2014 to $5.43 million, due to inflation modifications. Rule, an individual may make tax-free gifts of up to $14,000 (other than presents of future interests in residential or commercial property) per person per year to as lots of people as they desire. In addition, if a person quits to $145,000 (besides gifts of future interests in property) to his/her partner who is not a United States person, the present is ruled out taxable.

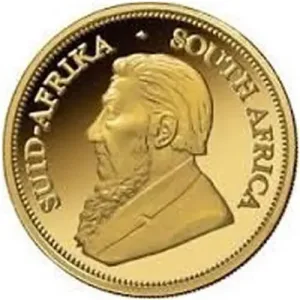

Gold and silver coins and bars are considered collectibles. Long-term capital gains on the direct sale of collectibles are taxed at a maximum rate 28%. For this reason, if you leave your successor bullions worth $10,000, the tax on that exchange could amount to $2800. But did you know that there are methods to bypass these taxes? It can be exempted from taxes if you give the antiques to them as a gift.

Given that gold and silver are much more inflation-resistant compared to paper currency, it is a great idea to purchase these precious metals and offer them to your children as gifts rather of simply composing them a check.

Rare-earth elements such as gold and silver bullions that you prepare to pass on to your recipients are included in the total worth of your estate. Depending upon the size of your estate, it might go through taxes, leaving your children and grandchildren with much less than you anticipated.

You and your spouse can independently give a gift amounting to $14,000 per year to the exact same recipient, which implies the individual can take pleasure in a tax-free gift totaling to $28,000.

Guideline, a person may make tax-free presents of up to $14,000 (other than presents of future interests in property) per person per year to as numerous people as they desire. In addition, if an individual provides up to $145,000 (other than gifts of future interests in property) to his or her spouse who is not a United States person, the present is not thought about taxable.