In the age of advanced technology, the digital realm offers a wealth of conveniences.

However, this digital age also brings about increased vulnerabilities. Scammers have

become more sophisticated, exploiting not only individuals’ fears but also their personal data.

One such scam targeting potential bank customers recently came to our attention at Bullion

Trading LLC.

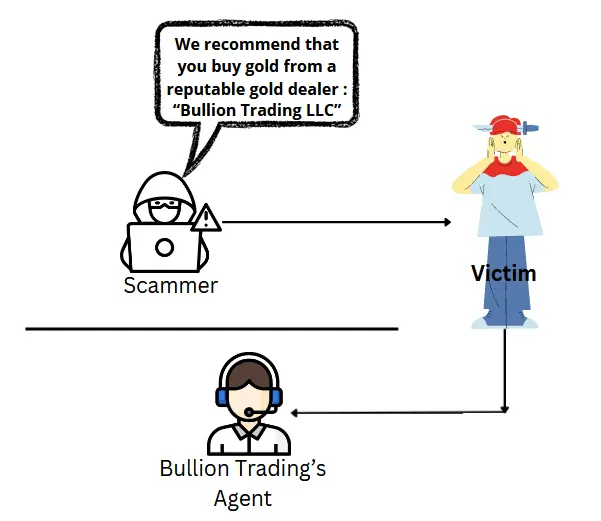

The Scam’s Modus Operandi

The scam begins with impersonators claiming to be bank agents. These fraudsters inform

the unsuspecting individuals that their bank is going bankrupt. The “agent” instills fear by

suggesting their savings are in jeopardy. Their proposed solution? To immediately pull out

their money and invest it in gold as a secure refuge.

Here’s where the plot thickens: these impersonators then cunningly direct the potential

victims to our reputable online business at “bulliontradingllc.com”.

How Do Scammers Get Your Personal Information?

To make their deception more believable, these scammers come armed with personal

information. But how do they obtain this data? Often, the answer lies in breaches of major

online platforms. Recent high-profile breaches include platforms like Twitter among others,

which saw the personal data of millions compromised.

Armed with this stolen information, scammers can convincingly pose as someone familiar,

like a bank agent specifically assigned to you. They’ll reference details about you to enhance

their credibility and further manipulate your decisions.

Example of Conversation Between Scammer and Victim

Phone Rings

Victim: Hello?

Scammer: Good day, Mr. Smith. This is John Doe, your dedicated agent from your bank. I hope you’re doing well?

Victim: Oh, hi. I wasn’t expecting a call. Is there an issue with my account?

Scammer: Well, Mr. Smith, I’m reaching out due to a concerning development. You might’ve

heard about the current financial instability affecting several banks, including ours. I wanted

to give our valued customers, like you, a heads up.

Victim: Financial instability? What’s happening?

Scammer: I can’t delve into the details over the phone, but there are whispers of an

imminent bankruptcy. I thought it best to alert you given the substantial savings you have

with us.

Victim: Bankruptcy?! What should I do?

Scammer: Well, Mr. Smith, considering the circumstances, a lot of our high-value clients are

turning to gold as a safe investment. Gold prices remain stable even during financial crises.

Victim: That sounds like a good idea. But I don’t know anything about buying gold.

Scammer: No worries at all. We’ve been directing our esteemed clients to a reputable gold

dealer we trust – “bulliontradingllc.com”. They have a track record of swift and secure

transactions.

Victim: That’s concerning news, but thank you for letting me know. How do I go about it?

Scammer: It’s simple. Just initiate a bank transfer to their account. They’ll handle the rest.

Remember, time is of the essence here. The sooner you secure your savings, the better.

Victim: Alright, I’ll look into it immediately. Thanks for the heads up.

Scammer: Just doing my job, Mr. Smith. Take care and be safe.

In this fabricated conversation, the scammer uses urgency, familiarity, and the victim’s fear to

manipulate the situation. As seen, they provide just enough “truth” to seem believable while

pushing the victim towards a hasty decision.

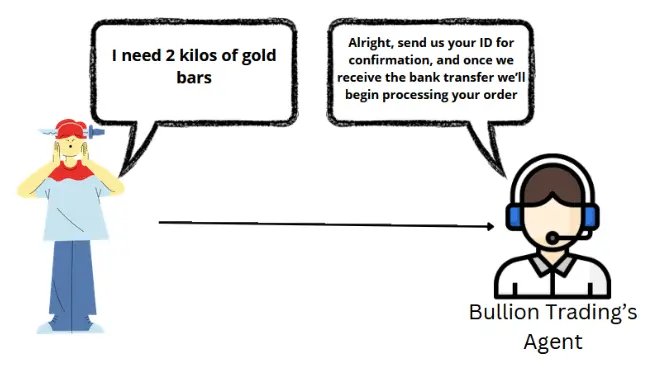

Example of Conversation Between Victim and Bullion Trading LLC Agent

Phone Rings

Bullion Trading LLC Agent (Agent): Hello, this is Sarah from Bullion Trading LLC. How can

I assist you today?

Victim: Hi, Sarah. I was directed to your website by my bank agent due to some financial

concerns. I’m interested in purchasing gold as an investment.

Agent: Of course, I’m here to help. Can you provide me with some details on the amount of

gold you’re looking to purchase?

Victim: I’d like to invest around $50,000. How do I go about the process?

Agent: Great choice. Firstly, for the transaction to be processed, we’ll need some

verification. Could you please provide your ID for the initial verification?

Victim: Sure, I can send over a copy of my driver’s license. Where should I send it?

Agent: You can securely upload it directly to our portal. I’ll send you a link via email. Once

we have verified your ID, we’ll provide you with our account details for a wire transfer.

Victim: Alright, I’ve uploaded it. And as for the wire transfer, I’ll initiate that as soon as I get

your details. I was told by my bank agent that this is urgent, so I’d appreciate a swift process.

Agent: Thank you for the prompt response. We always ensure our transactions are both

secure and efficient. I’ll review the ID, and once verified, you’ll receive the wire details. Once

we confirm the receipt of the transfer, we can proceed with shipping your gold.

Victim: Thank you, Sarah. I appreciate your assistance during these uncertain times.

Agent: It’s our pleasure. We aim to provide our customers with a seamless and secure

experience. Once the transaction is complete, we’ll send you all the necessary

documentation and tracking details for your purchase. Please don’t hesitate to reach out if

you have any further questions.

In this conversation, both parties are acting in good faith, with no inkling of the underlying

scam. The agent follows protocol, ensuring the transaction is legitimate, while the victim

believes they are making a wise financial move based on the earlier misleading call

Unraveling the Scam: Bullion Trading LLC’s Vigilance in Action

Awareness and vigilance are crucial in identifying and thwarting potential scams. At Bullion Trading LLC, we have always prioritized the safety of our customers and the integrity of our business dealings. It was this commitment that led us to uncover a concerning pattern in recent transactions.

Spotting the Red Flags

We began to notice an unusual trend when several clients mentioned concerns about bank bankruptcy in their communications with us. While every individual’s reason for investing in gold may differ, this repeated mention of a specific circumstance raised a red flag. Acting on our suspicions, we took the proactive step of directly inquiring with these customers. We asked if they were willingly proceeding with their order, highlighting that they might be victims of a sophisticated scam. By emphasizing our concern, we hoped to prompt them to pause, reflect, and possibly avoid a costly mistake.

Intervention and Assistance Our timely intervention bore fruit. Many grateful clients acknowledged that they had been misinformed and were on the verge of making hasty financial decisions based on deceitful advice. We were able to assist some of them by refunding their money, ensuring they did not suffer financially from this scam. However, not all stories had happy endings. In one distressing instance, a victim was duped not just once, but twice. After purchasing gold from us, other scammers, pretending to be agents, approached the individual, falsely claiming they needed to confiscate the gold as evidence in an ongoing investigation.

The Threat Looms Larger

Our investigations suggest that the scammers’ tactics might not stop at mere deception. Given they have access to personal data, there is a real fear that these criminals might resort to more direct, potentially dangerous methods. With the knowledge they’ve acquired, these scammers could potentially target victims’ homes, either by scamming their way in under some pretense or, in extreme cases, breaking in.

How to Prevent Yourself from Being Scammed

In today’s digital age, almost everyone shares some personal information online, making it challenging to entirely avoid being a potential target for scammers. However, there are proactive steps one can take to reduce the risk of falling victim. One of the most fundamental precautions is to keep your computer updated with the latest software patches and ensure you have reliable antivirus software installed.

If you ever receive a call from someone claiming to be from your bank or a representative from a service like PayPal, exercise caution. Never provide them with any codes received via SMS or share other sensitive details. It’s important to note that even if your account was genuinely blocked or there’s an issue, always opt to call the institution back using their official contact number, ensuring your safety.

Lastly, always remember that legitimate customer support from financial institutions won’t typically need your full bank details. They can handle most tasks by simply verifying your identity. Before providing any information, always verify the identity of the person or organization contacting you, ensuring your peace of mind and security.

Protect Yourself: What You Need to Know

- Guard Your Information: Despite advances in online security, breaches can and do occur. Always be cautious about the information you share online and where you share it.

- Bank Communications: Genuine banks won’t randomly call customers about bankruptcy. Should you get such a call, hang up, and contact your bank through their official communication channels.

- Never Share Sensitive Information Over Call: Even if the caller cites personal details about you, never share sensitive information over the phone. Authentic bank agents will never ask for personal details or passwords over a call.

- Research and Verify: Don’t act on impulse. Before making investment decisions or following through on an unsolicited phone call’s advice, verify the information independently. Check online, consult trusted acquaintances, or speak with a financial advisor.

- Secure Transactions: Always make purchases from trusted and verified dealers. At Bullion Trading LLC, we ensure every transaction’s authenticity, but it’s essential to be cautious and alert in every substantial transaction you make.

- Communicate with The Dealer: If something feels off, or if you’re unsure about a transaction, directly communicate with the dealer. By informing us of unusual recommendations or references, we can better track and identify potential scams.

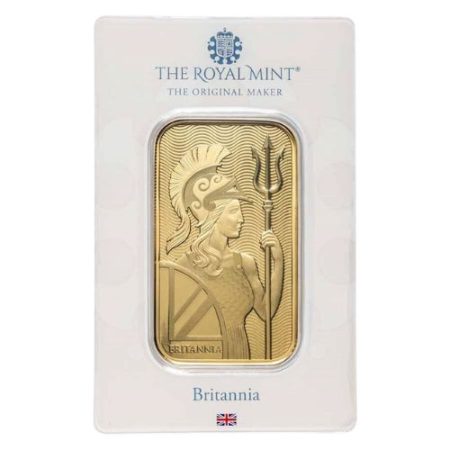

Popular Products

1 oz Lady Fortuna Gold Bar – 45th Anniversary

2024 1 oz Gold Bar PAMP – Legend of the Azure Dragon

1 oz Britannia Minted Gold Bar (In Assay)

$2,012.84