Not all analysts are optimistic on gold, Sean Lusk, co-director of industrial hedging at Walsh trading, stated that he sees gold prices pushing lower as the $1,520 level is showing to be a strong resistance barrier.

In the last study, Wall Street experts proved the most accurate as the bulk of individuals were neutral on gold for this present week. As of 11:47 a.m. EST, December gold futures last traded at $1,509.50 an ounce, up 0.21% from the previous week.

We discovered this excellent short article at https://www.kitco.com/news/2019-10-04/Kitco-News-Weekly-Gold-Survey-Don-t-go-quietly-into-that-good-night-Wall-Street-Main-Street-bullish-on-gold-prices.html By: Neils Christensen.

” Everywhere financiers look there is another worry,” said George Gero, managing director with RBC Wealth Management. “The U.S. dollar stays the greatest headwind for gold, but this unpredictability should continue to support rates around $1,500.”.

Richard Baker, editor of the Eureka Miner Report, also said that it appears like gold requires some fresh information as he sees rates trading back around $1,500.

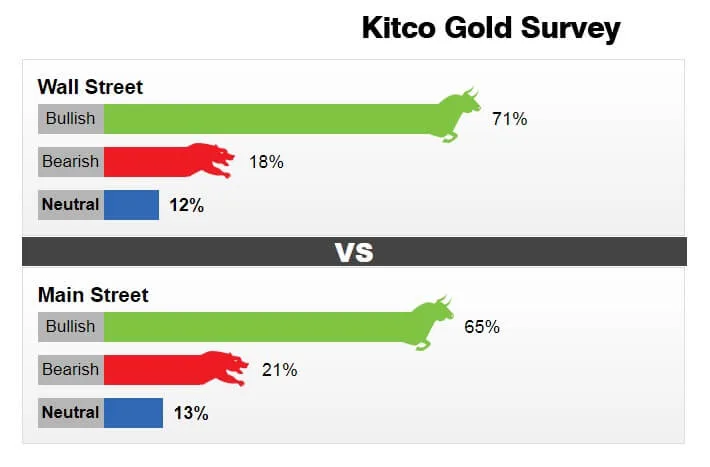

Wall Streets record is now 19-16 year to date, suggesting participants have been right 54% of the time. Meanwhile, Main Streets record fell to 18-17, meaning this group has been right 51% so far this year.

” As long as issues over slowing worldwide growth, political danger, trade uncertainty and Brexit drama among many other geopolitical risk elements stimulate threat aversion, Gold bulls will remain in the driving seat,” he stated.

Lukman Otunuga, senior research expert at FXTM, said that he sees the path of least resistance is higher.

He added that he does not see a great deal of new information entering into the market that will drive costs higher.

” I do not think the work data was a game changer,” said Fawad Razaqzada, technical analyst at City Index. “The Federal Reserve is still going to cut rates this month which will damage the U.S. dollar and push gold prices higher.”.

Another 2, or 18%, predicted gold would fall. A total of 446 voters, or 65%, called for gold to rise. Another 145, or 21%, forecasted gold would fall.” Gold appears to be pausing to examine its next instructions, looking at a financial outlook that is not so alarming as August, however with more motivation for Federal Reserve rate cuts given weak point in essential areas,” he said. “I believe Comex gold will pull back to the key $1,500-level next week however avoid a retest of Tuesdays low.

An overall of 446 citizens, or 65%, called for gold to rise. Another 145, or 21%, anticipated gold would fall.

Here is a post about gold price remains securely bullish after 2% loss at the start of the week. This is not our original article so we have actually included a link to the initial author at the end of this post.

Looking ahead, although a healthy jobs report is taking some momentum far from gold costs Friday, lots of experts still expect to see higher rates as the current employment data has actually not shifted expectations for another rates of interest cut from the Federal Reserve later on this month.

” Financial market uncertainty around the world is not disappearing anytime quickly and due to the fact that of that more financiers are searching for gold to break on the advantage,” he stated.

Some experts have noted that jobs data is a delayed indicator and the disappointing ISM data launched Tuesday and Thursday paint a photo of slowing economic growth in the U.S.

The CME FedWatch Tool reveals that markets see a nearly 80% chance of a rate cut on Oct. 30.

For many experts, golds capability to recoup a 2% loss at the start of the week and regain what ended up being a vital mental level is an indication of strong durability in the market. Many analysts have noted that growing economic crisis fears and monetary market uncertainty continue to support gold rates in the near term.

Gold bulls are keeping the drive alive as both Wall Street analysts and Main Street financiers stay securely bullish on the yellow metal as the cost has actually handled to restore the $1,500 level heading into the weekend, according to the most recent Kitco News Weekly Gold Survey.

” Gold appears to be stopping briefly to evaluate its next direction, looking at an economic outlook that is not so dire as August, however with more impetus for Federal Reserve rate cuts offered weakness in key areas,” he said. “I think Comex gold will pull away to the key $1,500-level next week however avoid a retest of Tuesdays low. Any unfavorable modification in this fragile political and geo-political environment could quickly return safe-haven demand and reignite a gold rally.”.

” I think today there are way a lot of longs in the marketplace and I believe we could see those investors start to leave if the market cant make brand-new highs,” he said. “We truly require brand-new details to press this market higher but I dont see where that will come from.”.

Twelve analysts or 71% stated they see greater prices next week. Another 2, or 18%, predicted gold would fall.

Afshin Nabavi, head of trading with MKS (Switzerland) SA, stated that he expects gold costs to trade nervously in between support at $1,485 and resistance at $1,520; however, he added that sentiment is still more bullish and he likes buying dips rather than offering rallies.