We discovered this short article at https://www.dailyforex.com/forex-technical-analysis/2018/02/gold-forecast-february-2018/90121 and thought it was something our fans would discover really beneficial.

Here is an article about the gold cost projection for the month of February. Gold rate projection is really crucial for gold buyers and financiers. Gold costs settled at $1332.58 an ounce on Friday, suffering a loss of 1.27% on the week, as the dollar edged up on a corrective bounce from current strong disadvantage pressure. While issues that the Federal Reserve will raise rates four times this year instead of the three might weigh on the gold market, current volatility in major equity markets around the world can restrict possible downside.

Here is an article about the gold rate forecast for the month of February. Gold price forecast is really important for gold purchasers and investors. If you have any concern or wished to check out the initial post you can discover the link at the bottom of the post.

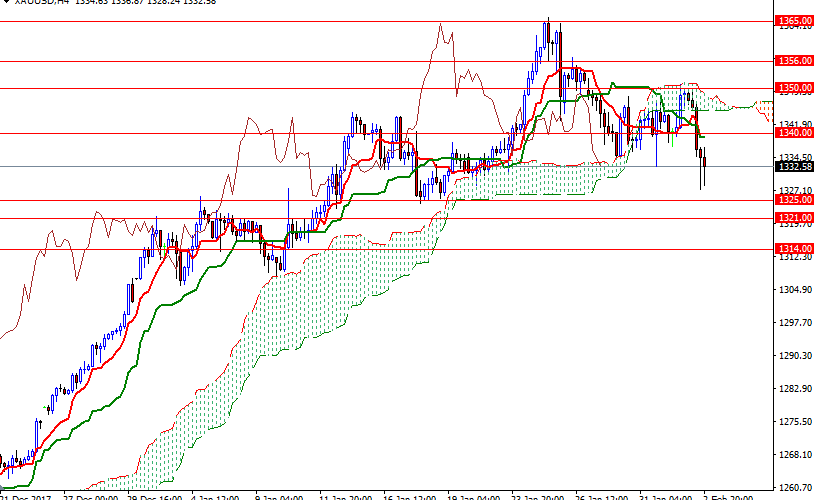

XAU/USD is trading listed below the Ichimoku clouds on the h1 and the h4 time frames, and we have adversely aligned Tenkan-sen (nine-period moving average, red line) and Kijun-sen (twenty six-period moving average, green line) on both charts. If the market cant remain above the 1326/1 location, rates will tend to move towards the everyday Ichimoku cloud. The assistance in the 1308/4 area should restrict any more declines but if it is broken, then the market will evaluate 1300-1298 next.

The first obstacle gold needs to jump is located in 1346/4. If the market can hold and penetrate this barrier above the 4-hourly Ichimoku cloud, then we may review 1351/0.

The U.S. dollar rose on Friday after the Labor Department reported that the economy added 200K jobs in January, exceeding agreement price quotes of 181K, and average hourly incomes jumped 0.3%. San Francisco Federal Reserve Bank President John Williams stated “Last year the Committee signified the possibility of additional steady rate increases in 2018, and, as I stated earlier, my own view is we must adhere to that plan.” While concerns that the Federal Reserve will raise rates 4 times this year rather of the three might weigh on the gold market, current volatility in significant equity markets around the globe can limit potential disadvantage.

Gold rates settled at $1332.58 an ounce on Friday, suffering a loss of 1.27% on the week, as the dollar edged up on a restorative bounce from current strong drawback pressure. The latest information from the Commodity Futures Trading Commission (CFTC) revealed that speculative traders on the Chicago Mercantile Exchange reduced their net-long positions in gold to 207262 agreements, from 214684 a week previously.