The cause of this contemporary circumstance can be traced back through the high run that the gold market has actually had over the last twelve years. Throughout this time, the production expenses for gold were not looked into because the gold prices were so rewarding. Without oversight, the rate to draw gold from the mines escalated, and had actually not been looked into up until the high costs dropped.

While lots of gold operations are looking grim, there are some companies that are saying that they can minimize the total production expenses next quarter. Whether this is going to originate from production costs or gold expenses is still unclear. Even with a few of the high-powered names attached to these forecasts, there is still a chance that numerous investors will not want to get on board in the next quarter, which could lead to fewer projects and even lower expenses.

Many manufacturers are feeling the crunch, there are numerous individuals who are suffering as a result of the low gold prices and from the original absence of forward-thinking. Lots of executives have actually been fired as an outcome of this rate reckoning while the marketplace index has actually fallen by 2 thirds in the last three years. Currently, it has to do with thirty-nine percent lower than it was simply 3 years ago.

While many mining outfits are still positive in the ability of gold to rebound in the market, financiers are not so persuaded. As a result, numerous of them are not tossing their assistance behind the current round of gold, reducing the quantity of upward capacity that gold has.

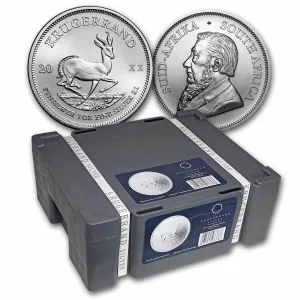

Gold is now at a 4 year all-time low following the most current stumble down to the rate of $1,160 an ounce over the last week. This puts the price over production costs for much of the mines operating in South Africa, consisting of the well-known Consistency Gold Mining, and puts much more developers within 50 dollars of being over production expenses.

Throughout this time, the production expenses for gold were not looked into because the gold costs were so successful. Numerous manufacturers are feeling the crunch, there are numerous people who are suffering as a result of the low gold rates and from the initial lack of forward-thinking. While numerous gold operations are looking grim, there are some business that are stating that they can minimize the overall production expenses next quarter.

According to a Canadian Brokerage Expert, John Ing, this has actually resulted in a tiered system of gold operations establishing. The leading tier of this brand-new system has the benefit of lower costs and better access to assets. The lower tier has high expenses operations, and is the one that is currently suffering under the brand-new gold market.

Nevertheless, spokespeople from production companies within the United States and other areas in North America have suggested that production in this part of the world will not suffer, due in part, to a stronger US Dollar. This split in the market will produce an extremely fascinating market transition over the next three months.