We found this excellent post at https://www.dailyfx.com/forex/market_alert/2019/02/18/Gold-Price-Nears-a-Fresh-10-Month-High-as-US-Dollar-Dips.html By: Nick Cawley and though it would be beneficial to our followers.

Here is an article about gold rates nears 10 month high. , if you desire to read the original post you can find a link at the end of this post.

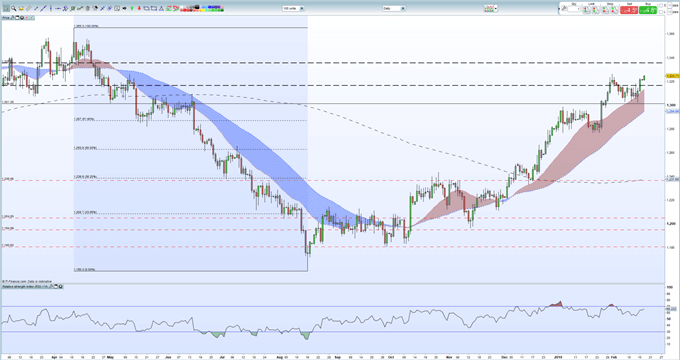

While United States dollar weakness is assisting fuel golds run higher, political risk remains – consisting of EU growth, Brexit and now Spanish elections – and might underpin the most current relocation. Retail belief reveals that traders remain long of gold– usually a contrarian bearish indication– while on the day-to-day chart the RSI sign is beginning to flash an overbought caution and ought to be enjoyed.

Gold may target $1,365/ oz. high as the US dollar takes a breather.Retail stay long however RSI cautions that the precious metal is ending up being overbought.

After a couple of attempts this month to break below the strong support around $1,303/ oz. gold bulls have reasserted themselves and pressed the precious metal sharply higher and to a brand-new monthly high. A weaker United States dollar has actually let gold run greater as US-China trade talks continue with talk that if the 2 are close to agreement, then the March 1 US tariff walkings on Chinese imports may be pushed down the line to help settlements.

.

A weaker US dollar has actually let gold run higher as US-China trade talks continue with talk that if the 2 are close to arrangement, then the March 1 United States tariff walkings on Chinese imports may be pressed down the line to assist negotiations.

While US dollar weakness is assisting fuel golds run greater, political risk remains – including EU development, Brexit and now Spanish elections – and might underpin the most current relocation. One negative may be that any sell-off in the Euro will see flows going back into the USD, weighing on the gold. Retail belief shows that traders remain long of gold– typically a contrarian bearish indication– while on the everyday chart the RSI indication is beginning to flash an overbought caution and ought to be enjoyed. On the disadvantage, the $1,303/ oz. area has held company since it was broken on January 25 and is followed by moving average support at $1,295/ oz. and 61.8% Fibonacci retracement at $1,287/ oz.

Retail traders are 70.3% net-long Gold according to the newest IC Client Sentiment Data, a bearish contrarian indication. Current modifications in weekly and everyday sentiment recommend that the price of gold might move greater in spite of traders long-positions.