December silver SIZ7, +0.01% shed 2.2 cents, or 0.1%, to $16.654 an ounce. The exchange-traded iShares Silver Trust SLV, +0.38% was down 0.3%.

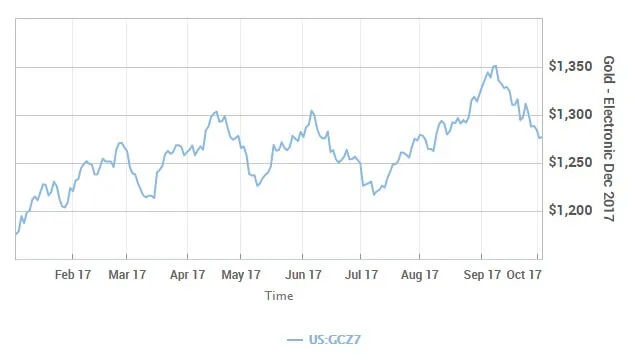

Gold for December shipment on Comex GCZ7, +0.02% fell $9, or 0.7%, to settle at $1,275.80 an ounce. The relocation comes after futures ended last week down roughly 1%, and shed 2.7% for the month, according to FactSet information. The yield on the benchmark 10-year Treasury note TMUBMUSD10Y, -0.57% was at 2.337%, versus 2.13% at the beginning of September. U.S. stocks, consisting of the Dow Jones Industrial Average DJIA, +0.31% and the S&P 500 index SPX, +0.07% traded in record territory.

The ICE Dollar Index DXY, -0.15% a step of the U.S. system versus a basket of 6 major competitors, was up 0.6% Monday, after reserving a 1% rise recently. A more powerful dollar makes products priced in the currency more pricey for buyers utilizing weaker currencies.

” Meanwhile investors are continuing to overlook geopolitical dangers, as their pressing appetite for threat continues,” said Razaqzada. “Dollar-denominated and safe sanctuary gold has actually subsequently fallen out of favor.”

The exchange-traded SPDR Gold Shares ETF GLD, +0.18% meanwhile, was off 0.5% in Monday negotiations.

Here is outstanding short article concerning gold costs. If desired to check out the initial post you can find the link at the end of this post.

Some upbeat financial data Monday feed expectations for an additional rate increase, with the Institute for Supply Managements production index leaping to 60.8 in September– its highest level since 2004.

Pressure for metals likewise comes as yields for Treasurys have climbed on heightened expectations for additional rate increases by the Fed prior to the end of 2017 and elevated hope that President Donald Trumps administration will execute tax policies, consisting of tax cuts and repatriation of money held abroad, that are considered professional market.

Gold for December shipment on Comex GCZ7, +0.02% fell $9, or 0.7%, to settle at $1,275.80 an ounce. The relocation comes after futures ended last week down roughly 1%, and shed 2.7% for the month, according to FactSet information.

” The brand-new week, month and quarter has started brightly for the U.S. dollar,” stated Fawad Razaqzada, technical analyst at Forex.com. In particular, the dollar acquired versus the British pound and the euro, with the euro “undermined in part by the controversial self-reliance referendum in Catalonia region of Spain at the weekend, while the pound has actually been struck by weaker-than-expected U.K. manufacturing PMI data.”

Razaqzada said that the dollar has been in demand over the past a number of weeks “as the bulls took benefit of oversold conditions on renewed hawkish rhetoric from the Federal Reserve to purchase the dip.”

Increasing yields can making owning gold, which does not bear a yield, less appealing compared to Treasurys and other instruments. The yield on the benchmark 10-year Treasury note TMUBMUSD10Y, -0.57% was at 2.337%, versus 2.13% at the beginning of September. U.S. stocks, consisting of the Dow Jones Industrial Average DJIA, +0.31% and the S&P 500 index SPX, +0.07% traded in record area.

Gold costs end lower Monday, marking their lowest finish in nearly two months, as a more powerful dollar and an increase in U.S. stock criteria into record territory dulled investment need for the valuable metal.

We found this excellent short article at (http://www.marketwatch.com/story/gold-trades-lower-as-dollar-equities-aim-higher-2017-10-02 By: Myra P. Saefong and Rachel koning Beals) and believed this something that our followers would find really useful.

In other metals trading, December copper HGZ7, +0.12% ended little bit altered at $2.956 a pound. January platinum PLF8, -0.26% edged up by $1.10, or 0.1%, to $916.60 an ounce, but December palladium PAZ7, +0.14% fell $25.55, or 2.7%, to $911.30 an ounce.