In summary, the mint offers stunning coins and medals on their site and if you desire them because of their charm and are not concerned about future value then by all ways proceed and purchase them. If you desire a much better deal it may pay to wait a few years to see if the cost has actually gone down. If the price of gold or silver skyrockets, then even bad financial investments can turn out excellent.

The article goes on to estimate numerous individuals who bought proof gold and silver coins, just to experience a significant loss on their investment. While there was no sign about the distinction in the area price of gold and silver at the times or purchase and sale, it seems they were given signs that these were good investments. In this case I blame both the buyer and the dealer who sold these coins, not the federal government. The purchaser obviously didnt do his due diligence and instead of buying bullion near its value, he purchased coins that would be thought about collectibles at a higher premium. And the seller was most likely encouraged by providing a product that would bring a higher commission. Buyer beware.

.

A front-page post in Mondays Wall Street Journal titled “U.S. Mint Makes a Mint Selling Gold Coins at a 25% Markup” enhances what I have actually been blogging about for many years, buying coins from the mint is not a smart ways of investing. In fact, the mint is actually operating in the exact same fashion as a coin dealership with an extensive list of items for sale on their web website consisting of a popup window that offers on-line chat with a live person. In reality, the mint has an unjust edge over my company, they dont gather New Jersey sales tax where I am needed to.

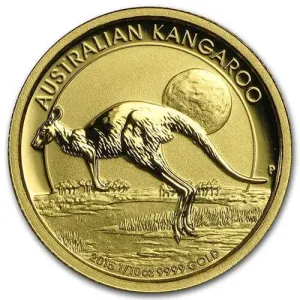

Although the mint has been striking one cent and five cent coins at a loss for many years, the mark-up on their item list more than makes up for the difference. Consider example the proof gold and silver coins which the mint has actually struck given that 1986. They are stunning coins, and the evidence condition describes the truth they are struck two times on highly polished blanks, but the mark-up over the bullion value is inflated. On their site the mint estimates a cost of $53.95 for a 1-ounce evidence silver eagle, an over 3 times mark-up over the silver worth when you can purchase a 1-ounce uncirculated silver eagle for around $6 over the bullion worth. Taking a look at the evidence gold eagle, the mints estimated price is $1610, a 25% premium whereas a 1 ounce uncirculated gold eagle would cost around $1400. Given, evidence problems usually have a lower mintage and for this reason ought to command a premium over the cost of uncirculated coins, but even the proof mintage figures are greater than what would be thought about scarce.

This is an outstanding article about purchasing gold and thought this was something that our subscribers would find extremely useful.

A front-page article in Mondays Wall Street Journal titled “U.S. Mint Makes a Mint Selling Gold Coins at a 25% Markup” reinforces what I have actually been composing about for years, buying coins from the mint is not a sensible methods of investing. Take for example the evidence gold and silver coins which the mint has actually struck considering that 1986. In previous years evidence gold coins and sets of the 1-ounce, 1/2-ounce,1/ 4-ounce and 1 1/10- ounce coins would bring a premium of $200 – $300 per ounce over their gold value in the secondary market. I advise if somebody is interested in purchasing gold, they should try to find the proof examples at the same mark-up as uncirculated coins in case the premium returns.

In prior years evidence gold coins and sets of the 1-ounce, 1/2-ounce,1/ 4-ounce and 1 1/10- ounce coins would bring a premium of $200 – $300 per ounce over their gold value in the secondary market. Presently nevertheless, there is no distinction in the premium whether purchasing or selling the uncirculated or proof concerns. I suggest if somebody is interested in purchasing gold, they ought to attempt to discover the evidence examples at the exact same mark-up as uncirculated coins in case the premium returns. Even if it doesnt, they still have actually purchased the gold at the lower uncirculated premium.

This excellent and intriguing content we discovered at http://www.shorenewstoday.com/brigantine/gold_and_silver_mine/the-gold-and-silver-mine-do-your-homework-before-buying/article_c7ff79b7-091b-54c7-9729-32f14b6be0c0.html By: Douglas Keefe.