After striking a cost of $1,370 per ounce, the rare-earth element has shown a substantial decline in current months; losing 12% of its value and falling to $1,200 per ounce. Financial and rare-earth element markets expert Dimitri Speck has actually explained to Sputnik why he is still promoting financial investments in gold regardless of its fall.

Speck described that the crucial difference between gold and currencies like the euro or dollar is that it is not some sort of product cash and its mass cant be increased arbitrarily. Gold likewise cant declare bankruptcy and be stated useless, the financial expert continued.

.

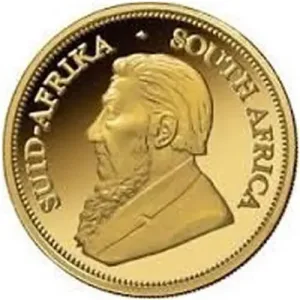

The expert anticipates that the cost of gold will rise significantly by the end of year and has recommended buying physical items, such as Canadian “Maple Leaf” gold coins or Vienna Philharmonic basic coins, citing a low buy-sell margin and absence of VAT payments.

When talking about forecasts by experts from the ICBC Standard Bank that gold price will reach $1,300 per ounce by the end of the year, Speck said that in the long run, prices are likely to go even higher. He explained that at least given that 2011 main banks have been actively printing cash and the majority of them were investing in property and stock markets, but not in gold.

Here is a short article about why it is best to invest in gold. , if you want to read the original post inspect the link at the bottom of this post.

We found this article at https://sputniknews.com/analysis/201809021067689871-expert-invest-gold/ and though it would work to our subscribers.

Speck likewise revealed apprehension over the dollars role as a leading world currency, saying it is presently in crisis due to the “high amount of United States debt.” He included that some nations have actually begun recognizing the benefit of gold, which “cant be politically cheapened.” The economist raised Russias Central Bank as an example. The banks has actually offered off a considerable part of its investments in US financial obligation while acquiring considerable quantities of gold. He believes that many countries will soon follow Russias match.