Gold and Silver Prices to Rise in 2024

This year, financial analysts at UBS, a leading global financial institution, anticipate a significant increase in the prices of gold and silver.

This projection is largely based on the expectation that the U.S. Federal Reserve (the Fed) will implement interest rate cuts, a move historically beneficial to the value of gold and silver.

This forecast is based on the fact that when interest rates go down, investments in gold and silver become more attractive. This is because lower interest rates mean people get less money from savings accounts and bonds, so they look for other places to invest, like in gold and silver. Also, when interest rates drop, the U.S. dollar usually gets weaker. This makes gold and silver cheaper for buyers from other countries, which can increase their demand.

Even though we’re not sure when the Federal Reserve will lower interest rates, demand for gold has already gone up. This is partly because of political issues around the world, which have pushed gold prices to a high point recently. This rise in demand shows that gold is seen as a safe place to put money when things are uncertain, making it even more attractive to investors.

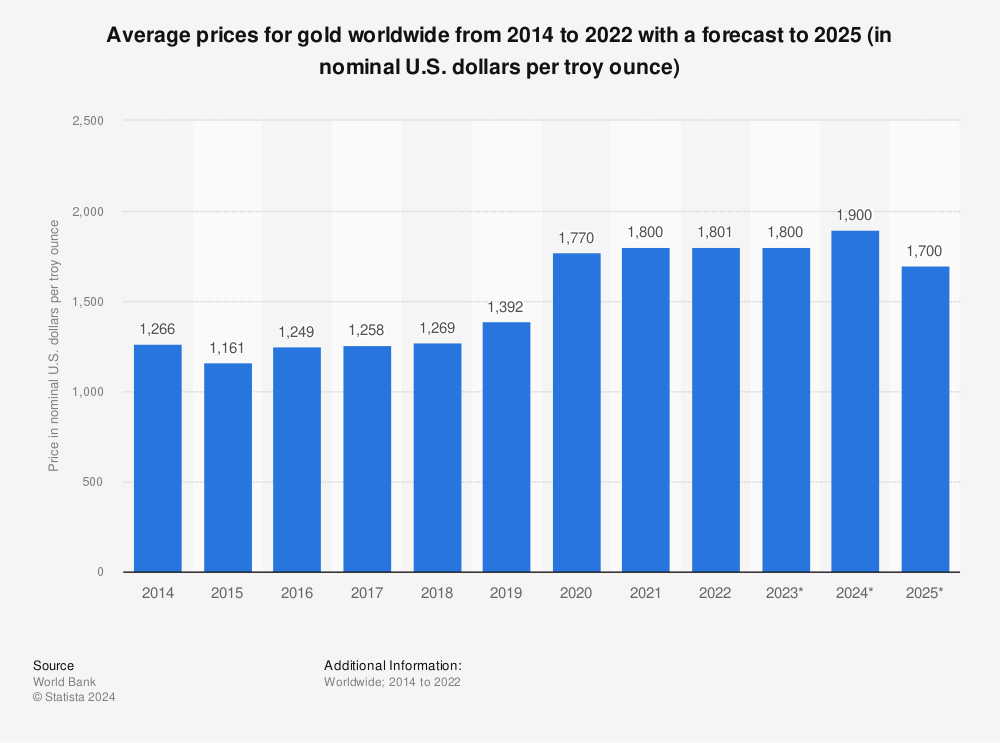

Understanding gold’s value as an investment requires a look at its price performance over time. The next graph presents the average prices for gold worldwide from 2014 to 2022, with a forecast extending to 2025. This visual data underscores the historical trends and the anticipated appreciation in gold’s value, particularly in light of potential economic and monetary policy shifts.

Now, let’s see gold’s price trend. Here’s a graph of gold prices from 2014 to 2022 and predictions up to 2025:

If you’re thinking about adding some gold or silver to your investment mix, now looks like a good time. Bullion Trading LLC has a wide range of gold and silver bars and coins, making it easy to start investing in precious metals. Buying gold or silver today, before prices are expected to go up, could mean you’ll be able to sell them later at a higherprice.

Silver, in particular, may present a unique opportunity. Its extensive use in industrial applications—including automotive manufacturing, solar energy, and electronics—means its price may increase alongside economic recovery and growth. The dual role of silver as both a precious and an industrial metal adds an interesting dimension to its investment potential, especially considering the prospects for economic recovery and technological advancements.

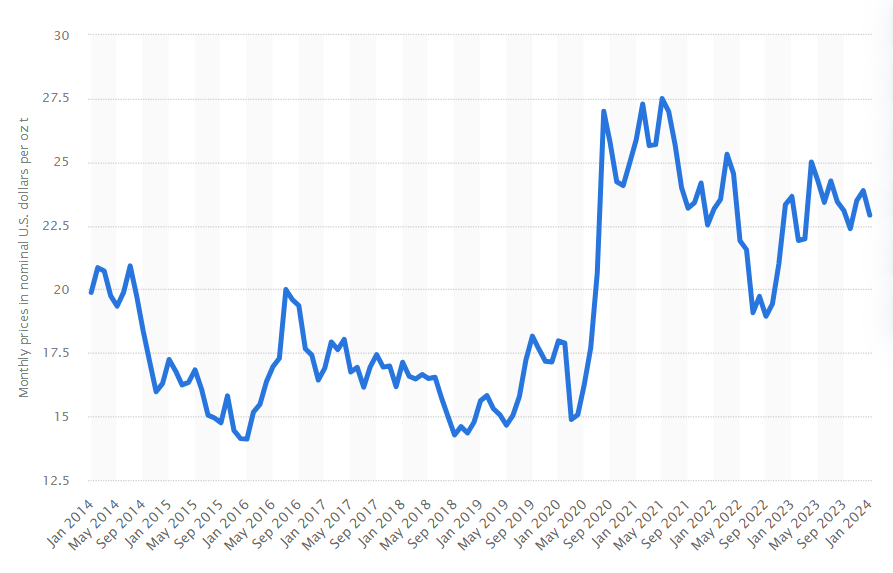

Let’s look at how silver prices have changed over the past 10 years. This graph shows the prices from January 2014 to January 2024:

Currently, gold is priced at around $2,202.35 per ounce, and silver at $25.72 per ounce. These prices could potentially rise if the Federal Reserve decides to cut interest rates. Keeping an eye on gold and silver price trends will be important as we move into 2024. With potential rate cuts, ongoing geopolitical tensions, and patterns of economic recovery, the market for precious metals is likely to see a lot of action.

As we move forward, the partnership with Bullion Trading LLC offers a valuable resource for investors looking to explore the opportunities in precious metals investment. Their expertise and comprehensive selection of investment-grade metals provide a solid foundation for making informed decisions in the evolving economic landscape.