This is an outstanding article about Gold Buying Rises. , if you have any questions about the short article or you would like to view the initial article the link to it is at the end.

That liquidation contrasts with the greater count of people selecting to buy gold in September, and reflects selling by a little number of larger financiers. Its versus such measures of weight that the Gold and Silver Investor series really use insight, showing exposed choice– not survey-based intentions– amongst the worlds largest single swimming pool of self-directed bullion investors.

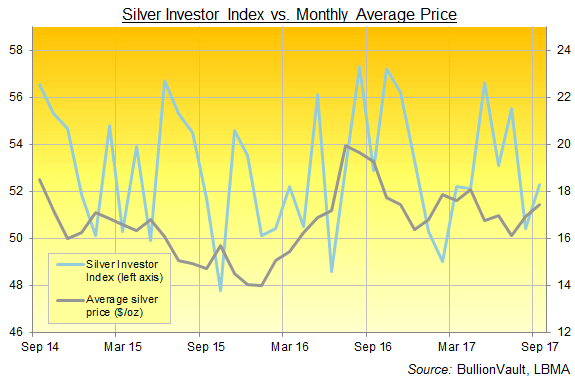

The variety of people offering silver fell 16.1% last month while those beginning or adding to their silver holdings grew 17.3% from Augusts two-year low.

By weight however, overall client silver holdings ended last month the same at Augusts brand-new record high above 689 tonnes.

That took the Silver Investor Index up from 50.4 to 52.3 as Dollar costs averaged a 3.2% rose at $17.45 per ounce.

.

While falling dramatically from 8 Septembers 1-year high to end last week at $1283, gold rates balanced $1314 throughout the month, rising 14% from completion of 2016 and 23% above the 6-year low hit at the end of 2015.

All told, Septembers solid upturn in gold buying and silver investing belief matches the steady combination in costs after last years Brexit and then US election volatility.

We discovered this post at https://www.bullionvault.com/gold-news/buying-gold-1003210171 by: Adrian Ash and believed this was something that our subscribers might find very beneficial.

Entirely this saw the Gold Investor Index– a distinct step of sentiment developed from the purchasing and selling choices of countless private financiers– increase in September to check out 54.5 from the 14-month low of 51.6 hit in August.

Last month marked the very first time considering that August 2016 that the Gold Investor Index increased together with month-average gold costs, and the first time the 2 moved together since last Decembers drop.

Long-lasting bull markets require to keep discovering purchasers as costs rise. And 2017s earlier pattern of bargain-hunt buying followed by fast profit-taking in might not be completed yet in precious metals.

The variety of individuals buying gold grew however on BullionVault– the worlds largest online market for physical rare-earth elements– expanding by 21.5% from August to reach the second-highest regular monthly total up until now in 2017.

The variety of sellers meantime pulled back by 29.5% having almost doubled on Augusts price increase to reach the largest number since July 2016.

The NUMBER of personal financiers purchasing gold increased dramatically in September even as costs taped their greatest monthly average in a year, composes Adrian Ash at BullionVault.

This breaks 2017s previous pattern, when gold investing belief moved inversely to the metals month-average Dollar expense and higher prices hindered new buying.

Gold holdings meantime shrank for the second month running, falling by 43kg to 37.7 tonnes after setting a new record above 38.1 tonnes in July.

Trading live online for instantaneous settlement of physical metal in London, New York, Singapore, Toronto or Zurich, BullionVault users today own $1.6 billion worth of gold bullion between them (₤ 1.2 bn, EUR1.3 bn, ¥ 175bn)– more than is held by most of the worlds main banks– plus a more $374m (₤ 279m, EUR316m, ¥ 42bn) in physical silver and $8m (₤ 6m, EUR7m, ¥ 900m) of physical platinum, contributed to BullionVaults online order board in March 2017 in partnership with the mining-backed World Platinum Investment Council.

Silver sentiment also rose with month-average prices in September, again breaking the previous 2017 pattern and recovering from Augusts 6-month low as buying grew.