. U.S. 10-year Treasury yields dropped to the most affordable given that December 2017 earlier in the session.

To name a few valuable metals, silver rose 1.2% to $14.62 per ounce, while palladium edged 0.2% greater to $1,316.80.

” We have actually seen a sharp turnaround in the dollar and that has actually helped buoy gold costs,” said Suki Cooper, rare-earth elements analyst at Standard Chartered Bank.

The Fed officials at their last meeting agreed that their current patient method to setting monetary policy might stay in location “for a long time,” a further sign policymakers see little requirement to adjust rates.

The dollar index, which earlier in the session touched its highest level in two years at 98.371, gave back some gains after the release of U.S. weekly out of work data.

.

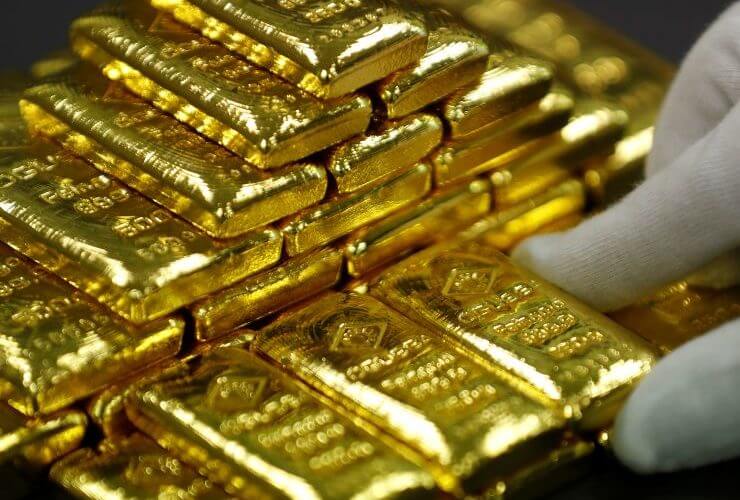

Area gold climbed 1 percent to $1,285.63 per ounce by 11:21 am EDT (1522 GMT), after falling to its most affordable given that May 3 on Tuesday at $1,268.97.

China stated the United States requires to remedy its “incorrect actions” for trade speak to continue after it blacklisted Chinese technology company Huawei Technologies Co Ltd

World shares fell as concerns grew that the China-U.S. trade conflict was quick developing into a technology cold war in between the worlds two largest economies.

Lower interest rates tend to raise gold as it reduces the chance expense of holding the non-yielding bullion.

Gold prices jumped 1 percent on Thursday as the U.S. dollar pulled back from a two-year peak scaled earlier in the session and as international equities moved on the escalating Sino-U.S. trade tensions.

U.S. gold futures rose 0.9 percent to $1,285.50 an ounce.

Platinum rose 0.2% to $800.52 an ounce, after touching the most affordable since Feb. 15 at $791 earlier in the session.

” Yields are (likewise) a bit lower and equity markets are down (supporting gold),” said ABN AMRO analyst Georgette Boele.

Here is a post about gold costs rise after dollar draws back. , if yo desire to read the initial article you can find the link at the bottom of this post.

We discovered this post at https://www.cnbc.com/2019/05/23/gold-market-us-china-trade-war-brexit-in-focus.html

” After the U.S. Federal Reserve stated it would remain client the marketplace has taken this as a favorable hint and has started to rate in the higher possibility of a rate cut,” Cooper included.