In worldwide markets, spot Brent petroleum prices are down by 0.2% at $63.11 per barrel. The yield on United States ten-year treasuries is weaker at 2.32% and the German ten-year bund yield is at 0.35%.

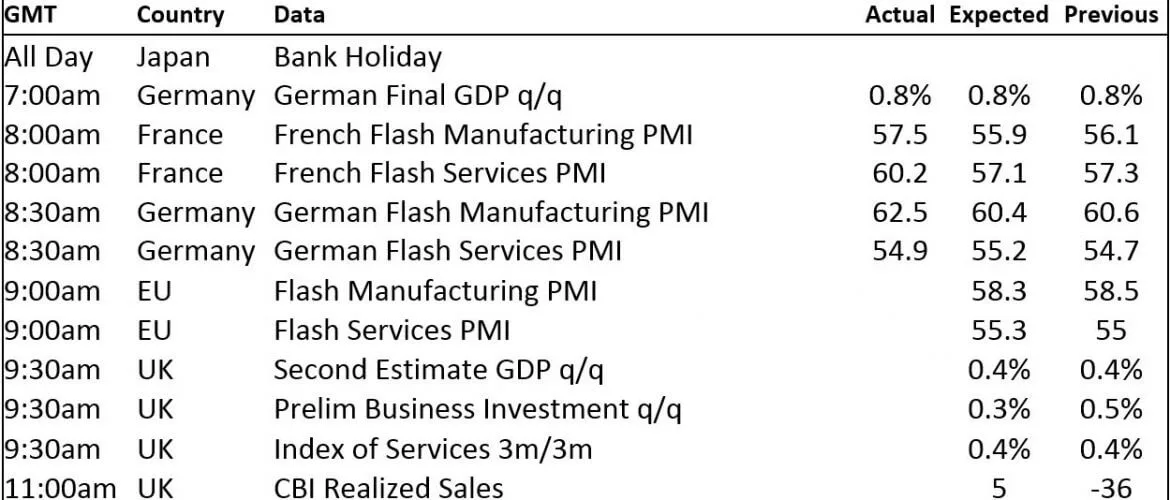

The economic program is busy today, with flash acquiring managers index (PMI) information out across Europe, German gross domestic item (GDP) which rose by 0.8% quarter on quarter and later there is also information out on the United Kingdoms GDP, service investment, index of services and CBI realized sales. Earlier, French PMI information beat expectations by a big margin, supporting our view that we are seeing concerted worldwide growth.

Equities in Asia today are weaker, led by a 3.02% fall in Chinas CSI 300, the Hang Seng is off by 0.66% and the Kospi is down 0.13%. The ASX 200 is the same and the Nikkei is closed. The weak point in Chinese equities appears to be on issues about a correction in the bond market. Todays weakness follows a drop in western markets on Wednesday where in the United States the Dow Jones shut down by 0.27% at 23,526.18 and in Europe where the Euro Stoxx 50 closed down by 0.47% at 3,562.65.

Equities in Asia this morning are weaker, led by a 3.02% fall in Chinas CSI 300, the Hang Seng is off by 0.66% and the Kospi is down 0.13%. This mornings weak point follows a drop in western markets on Wednesday where in the United States the Dow Jones closed down by 0.27% at 23,526.18 and in Europe where the Euro Stoxx 50 closed down by 0.47% at 3,562.65.

This is a terrific post about Gold, platinum and silver rates and thought this is helpful to our fans. If you wish to read the initial short article you can find the link at the end of this post.

In other metals in China, iron ore rates are up by 4% to 491.50 yuan per tonne on the Dalian Commodity Exchange, steel rebar prices on the SHFE are up by 0.8%, and SHFE gold and silver rates are bit altered.

With equities still generally positive, the opportunity cost of holding bullion is high, however the truth precious metals costs are not trending lower provided the strength in equities is notable. The weaker dollar ought to help underpin firmer precious metals rates.

Volume has been average with 6,300 lots traded as of 07:14 GMT.

This interesting article we discovered at https://www.bulliondesk.com/gold-news/gold-silver-platinum-prices-found-bases-look-set-remain-rangebound/ by: Metal Bulletin Research

The exact same is real for zinc and nickel prices, while lead rates are weaker and aluminium and tin are consolidating. We are wary of the pullback in Chinas equity market in case it triggers follow-through weak point, however with iron ore and steel prices rallying highly in China today, it does look as though it may be a separated occasion.

Metal Bulletin releases live futures reports throughout the day, covering major metals exchanges news and costs.

The weaker tone from the FOMC minutes has actually pushed the dollar lower as seen by the dollar index that has actually fallen to 93.22, down from 95.15 in late October and early November. The other currencies are increasing on the back of the weaker dollar with the euro at 1.1837, sterling at 1.3309, the yen at 111.20 and the Australian dollar at 0.7615.

The yuan at 6.5830 is also more powerful and the other emerging currencies we follow are reinforcing too.

This follows a combined efficiency on Wednesday in which aluminium and copper prices increased by 0.6% and 0.3% respectively, lead rates fell by 0.6% and the rest were bit changed.

On the Shanghai Futures Exchange today, the base metals complex is split into two camps: lead rates are giving the worst performance with a 2.4% drop, tin costs are down by 1% and copper rates are off by 0.1% at 53,930 yuan ($ 8,150) per tonne, while nickel, zinc and aluminium costs are up by 0.5%, 0.4% and 0.3% respectively. Spot copper costs in Changjiang are off by 20 yuan per tonne at 53,780-53,950 yuan per tonne and the LME/Shanghai copper arbitrage ratio is unchanged at 7.79.

This follows a stronger efficiency on Wednesday when the complex closed with gains of between 0.3% and 0.7%– it appears the market read the US Federal Open Market Committee (FOMC) minutes as being more dovish than expected.

The rare-earth elements are also bit altered this morning, with gold and platinum rates off 0.1%, while silver and palladium rates are unchanged. Area gold rates were recently priced quote at $1,289.88 per oz.

Base metals traded on the London Metal Exchange are for the many part weaker this morning, Thursday November 23, with prices down by an average of 0.4%. Lead (-1.2%) and nickel (-1.1%) lead on the disadvantage, while the rest are in between the same and down by 0.2%. Three-month copper costs are off by 0.2% at $6,922 per tonne.

Base metals traded on the London Metal Exchange are for the a lot of part weaker this early morning, Thursday November 23, with prices down by approximately 0.4%. Lead (-1.2%) and nickel (-1.1%) lead on the downside, while the rest are in between the same and down by 0.2%. Three-month copper prices are off by 0.2% at $6,922 per tonne.