Here is a short article about how you can digitally buy gold. If you wish to see the original post you can find the link at the bottom of this post.

You know the strengths of a varied portfolio. Stock gains do not last forever and you require possessions that wont lose out to high inflation or unfavorable real rates of interest. Many financiers have actually been turning to gold, keeping it in a satellite position that occupies anywhere from 3 to 25 percent of their portfolio (or perhaps more). They have plenty of factors for making the relocation in an economy thats beginning to reveal cracks in the structure.

For those of you who have chosen that purchasing gold is among the best methods to produce a more powerful, more varied portfolio, the primary step is finding out how you ought to in fact buy it.

For those of you who have actually decided that purchasing gold is one of the best ways to produce a more powerful, more diversified portfolio, the initial step is finding out how you need to really purchase it.

WHY BUY GOLD BULLION

Going traditional takes full advantage of the benefits that draw investors to gold in the first place when it comes to this distinct financial investment product. Financiers who enter into rare-earth elements wish to:

Secure their buying power from currency debasement (i.e., the Federal Reserves quantitative easing program) and inflationKeep their money in a liquid possession similar to cash however not a currency thats as vulnerable to the economy; the appeal of gold is an intrinsic value that has actually survived through countless years of altering economic systems throughout culturesHedging versus the stock marketAvoiding third-party risks, such as mismanagement and bail-in programs

While futures and ETFs are options for financiers, gold bullion is the only alternative that pleases all of these advantages.

HOW TO BUY GOLD ONLINE

When you invest, you want it to be simple and fast? As simple as investing into equities. Thanks to new online alternatives, its now that simple to buy gold. Follow these easy steps and consist of gold in your portfolio today:

1) FIND AFFORDABLE COINS AND BARS

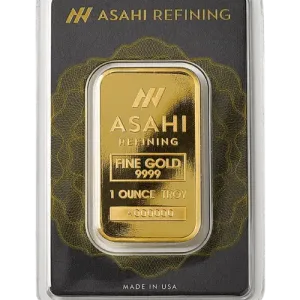

There are a lot of respectable sellers out there who supply gold coins and bars from mints and personal refiners from around the world. Adhere to bullion coins that are 99.99% pure gold (although American Gold Eagles and South African Krugerrands, at 22 karats rather of 24, are exceptions to the rule). Gold bars can be an even better offer, as they frequently have lower premiums thanks to lower production costs.

2) FIND A SELLER WITH IRA-ELIGIBLE GOLD

Discover another seller if you cant buy gold bullion as part of a tax-advantaged cost savings account. In the US, bullion is now accepted in IRA accounts and can assist you conserve when you squander your returns.

3) FIND A STORAGE OPTION

For smaller sized financial investments, a home safe may work just great. If youre investing larger sums, consider saving your gold in designated storage.

CONSIDER OTHER PRECIOUS METALS

When you buy gold digitally, you can save money and invest quickly and conveniently. The more you conserve, the simpler it is to enhance your returns.

Theres more than one valuable metal readily available if you want to further diversify. Utilized in everything from bullion coins to jewelry to electronics, they use you options.

We found this post at https://techaeris.com/2019/07/28/how-you-can-digitally-invest-in-gold and believed it would be extremely helpful to our followers.

Lots of financiers have been turning to gold, keeping it in a satellite position that inhabits anywhere from 3 to 25 percent of their portfolio (or even more). Thanks to new online alternatives, its now that simple to purchase gold. Follow these easy actions and consist of gold in your portfolio today:

There are plenty of credible sellers out there who provide gold coins and bars from mints and personal refiners from around the world. Stick to bullion coins that are 99.99% pure gold (although American Gold Eagles and South African Krugerrands, at 22 karats instead of 24, are exceptions to the guideline).