Understanding the relationship between gold and inflation reveals gold’s role as a stable asset in financial planning, offering protection against economic uncertainties and fluctuating currency values.

The Basics of Inflation

To grasp the significance of gold in financial planning, we first need to understand inflation. Simply put, inflation is when prices go up over time, decreasing the value of money. Imagine if a sandwich costs $5 today; with inflation, that same sandwich might set you back $6 or more next year. If this trend continues and our savings don’t grow at the same rate or faster, we could find ourselves with less purchasing power in the future.

Why Gold Matters

This is where gold, and specifically bullion gold, comes into the spotlight. Bullion gold refers to pure gold, molded into forms like bars or coins, and is different from jewelry or gold found in electronics. Historically, gold’s value has been notably stable, especially when compared to volatile assets or currencies that might fluctuate with inflation rates or economic crises. Gold’s stability stems from its rarity. While paper money can be printed based on government decisions, there’s a finite amount of gold on Earth. This scarcity, combined with its universal appeal, makes gold a sought-after asset, especially in unpredictable economic climates.

The Modern Dance of Inflation and Gold

The dynamics between inflation and gold are complex. When inflation rises, many investors and financial experts turn their eyes to gold. Its consistent value offers a safety net against the fluctuating purchasing power of paper currencies. Platforms like Bullion Trading LLC have observed and researched these trends, offering insights into the gold market’s behavior in the face of global economic shifts.

In Conclusion

The relationship between inflation and gold is long-standing. As we move through economic cycles, inflation’s shadows often lead investors to seek refuge in the time-tested stability of gold. The dance continues, and as history has shown, gold often moves in step with inflation’s ebb and flow. Whether you’re a seasoned investor or just starting to explore financial strategies, understanding this relationship can offer clarity in a world of economic uncertainties.

Some Popular Gold Coins and Bars that might interest you

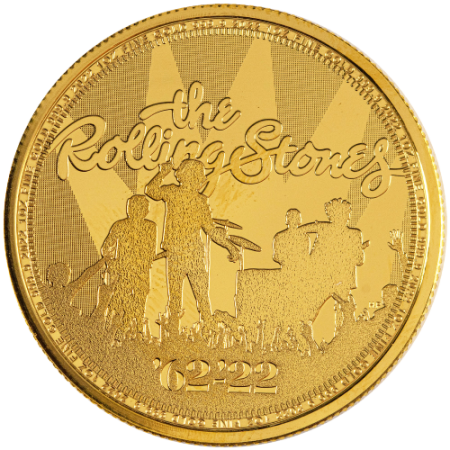

1 oz Rolling Stones Gold Coin

1 Gram Gold Bar – Random (In Assay)

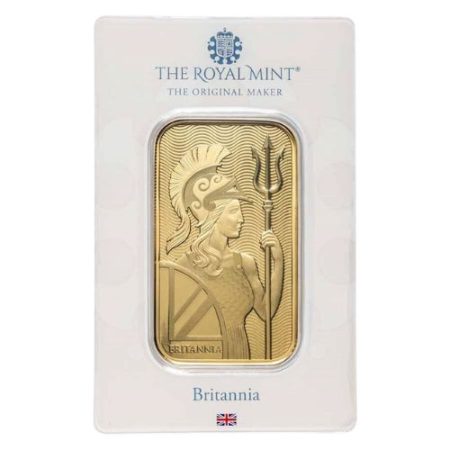

1 oz Britannia Minted Gold Bar (In Assay)

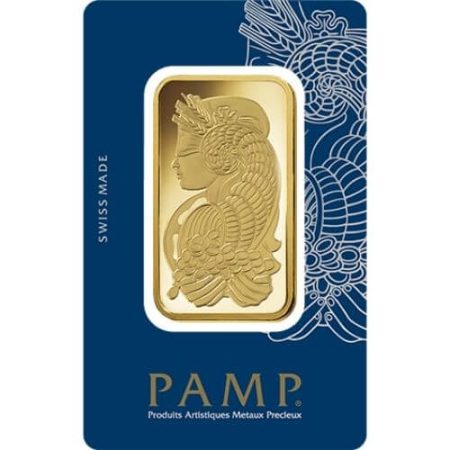

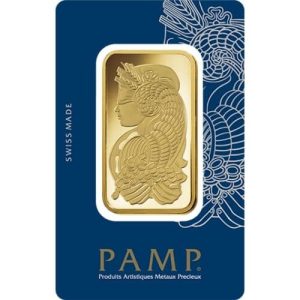

1 oz PAMP Suisse Gold Bar – Lady Fortuna (In Assay)

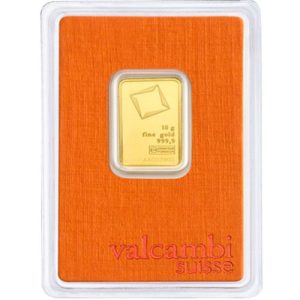

10 x 1/10 oz Valcambi Gold CombiBar (In Assay)

1 oz PAMP Suisse Rosa Gold Bar (In Assay)

$2,029.34