Here is a great article about the reasons why financiers need to not stress todays gold rate drops. , if you wanted to read the initial short article you can find the link at the end of the post.

.

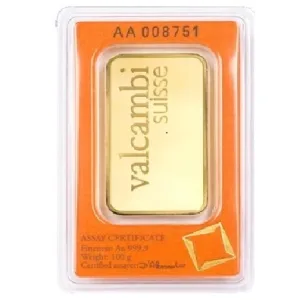

Gold costs took a hit at the end of recently, and it has actually some observers concerned.

The fact is it should not be worrying. Heres what you require to know:

Gold rates primarily move down when the dollar gains strength. Over the same time duration, the rate of gold dropped by approximately 6%, according to data from the London Bullion Market Association supplemented with other market information. The truth that gold prices move up and down is one of its tourist attractions for investors. When share costs drop then gold prices might move up down or remain unchanged. If you own gold and are fretted that costs may drop then believe about why you bought it in the first place.

We discovered this article at https://www.forbes.com/sites/simonconstable/2018/06/18/5-reasons-the-drop-in-gold-prices-shouldnt-worry-investors/ By: Simon Constable

All these points stay true despite Fridays pullback. Then think about why you acquired it in the first place, if you own gold and are stressed that costs may drop. Most seasoned financiers say that they own it for among the following three reasons: To assist with portfolio diversification, or as a hedge against the decreasing worth of paper cash, or as insurance coverage that youll constantly have the ability to raise money by selling a few of the metal.

Heres why gold investors should not worry.

A 2% relocation in a day isnt much. If the rate fell that much every day for a prolonged duration, then losses would quickly mount, however up until now we arent there.

Gold prices mainly move down when the dollar gains strength. And it has been strong because January versus the worlds other leading currencies such as the Japanese yen, the euro, and the British pound. When the dollar gains worth, then anticipate gold costs to fall. Given that late January the value of the dollar index versus major currencies has risen by around 5%, according to data from the Federal Reserve Bank of St. Louis. Over the very same period, the rate of gold visited roughly 6%, according to information from the London Bullion Market Association supplemented with other market data. In other words, the upward motion in the worth of the dollar is overwhelmingly responsible for the cost relocations. This relationship typically works vice versa as well.

When gold prices do poorly, then other investments tend to do well. Over the two years from 1980 through the year 2000 the price of bullion dropped from a high of $850 an ounce down to less than $300.

Gold is still useful to own during times of market stress. Thats real even though we arent there now. During the 2008-2009 monetary crisis, there were periods when certain securities couldnt be sold. An example of that is the market for auction rate auction rate securities, a type of bond. If you owned those notes throughout that period, then you couldnt offer them no matter how low a rate you used. Nevertheless, the market for gold never dried up. There were always all set purchasers for the metal or the futures. It must be evident that currently, the securities markets are not worried. Stocks are growing, and financiers are gladly trading bonds.

The truth that gold rates move up and down is one of its destinations for financiers. Simply like other financial investments, the price of gold modifications from day to day. When share costs drop then gold rates may move up down or stay the same.

The cost of bullion fell more than $20 a troy ounce in between Thursday and Friday, hitting a low around $1,279.