When it comes to precious metals investment, two names invariably dominate the conversation: gold and silver. Both metals have been coveted since ancient times, serving as symbols of wealth, power, and tradition. However, in the modern investment landscape, which one offers a better avenue for potential growth and stability? Let’s delve into a comparative analysis between gold bullion and silver bullion, especially for those contemplating an investment with reputable firms like Bullion Trading LLC.

Price Point & Affordability

Gold has always been priced significantly higher than silver. For beginners or those with a limited budget, silver bullion may provide a more accessible entry point. This lower price point means that investors can accumulate more physical silver for the same amount of money as they would spend on gold.

Market Volatility

Historically, silver tends to be more volatile than gold. This higher volatility can present more opportunities for short-term traders, but it might be seen as a drawback for those looking for a more stable long-term investment. It’s essential to assess your risk tolerance when choosing between the two.

Industrial Demand

Silver’s industrial demand is broader than that of gold. Silver is extensively used in electronics, solar panels, and numerous other applications. This diverse industrial usage can influence silver prices, potentially offering both risks and rewards for investors.

Historical Ratio (Gold-to-Silver Ratio)

The Gold-to-Silver ratio represents how many ounces of silver it takes to purchase one ounce of gold. This ratio has varied over time, and when it’s historically high, it might suggest that silver is undervalued compared to gold (and vice versa). Investors often use this ratio to gauge the relative value of the two metals.

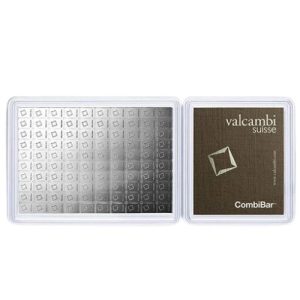

Storage Considerations

Given the price difference, a substantial investment in silver would mean storing a larger volume compared to gold. If storage space or storage fees are a concern, investors might lean towards gold bullion for its higher value density.

Historical Preservation of Wealth

Gold has been a steadfast representation of wealth for millennia. Its ability to preserve wealth is well-documented throughout history. While silver also acts as a store of value, many investors view gold as the ultimate hedge against economic instability

Conclusion

Both gold and silver bullion offer unique advantages for investors. Your decision to invest in one over the other should be based on your financial goals, risk tolerance, investment horizon, and the current market scenario. Whether you lean towards the age-old stability of gold or the versatile potential of silver, trusted platforms like Bullion Trading LLC stand ready to assist you in your investment journey.

Some Popular Gold Products

1 Kilo Gold Bar Random Brand(New Condition)

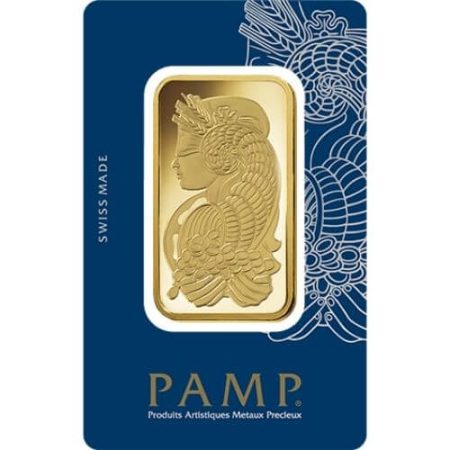

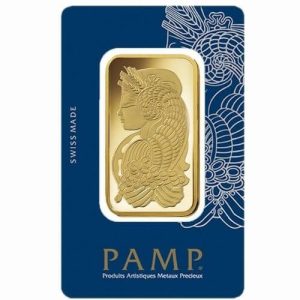

1 oz PAMP Suisse Gold Bar – Lady Fortuna (In Assay)

10 oz Gold Bar Pamp Suisse Lady Fortuna(In Assay)

$20,116.67

Some Popular Silver Products

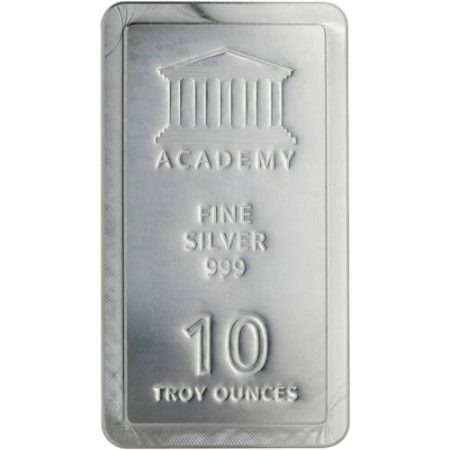

Academy 10 oz Silver Bars Stackable

10 oz Secondary Market Silver Bar

5 oz Italpreziosi Silver Cast Bar

$151.29