Monday-Thursday 8:30AM – 4PM CST

Friday 8:30AM – 1PM CST

Monday-Thursday 8:30AM – 4PM CST

Friday 8:30AM – 1PM CST

Showing 1–12 of 89 results

Physical Gold Bars are often the most popular choice among investors and collectors. The Gold Bars for sale are available in different forms like coins, rounds, and bullion bars. Gold Bullion for sale is available in the precious metal market without weight restrictions. Still, gold ingot is available in standard gold bars shapes such as (1 oz and 10 oz) with a limit on the purity that cannot exceed. Due to the high value of gold compared to other bars, investors can gain higher value from gold bars. And, if you get well return means the gold bullion bars can be considered a bar of pure gold.

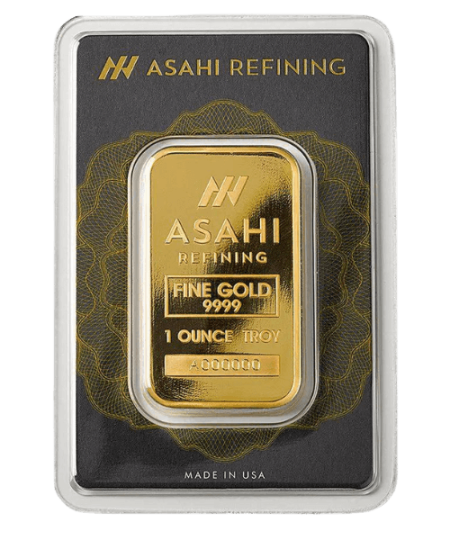

Gold bullion bars are available in different sizes up to several kilograms; however, the 1oz gold bars are the most common sizes. Today most gold ingots contain.9999 pure gold (cast vs. minted ingot), regardless of weight or kind. This means these products are made with less amount of impurities by melting gold and pouring it into a mold. Gold Bullion Bars for sale are sealed in an assay card that shows the appropriate serial number, weight measurement, and other relevant data. Gold Ingot also comes with a unique serial number.

Gold prices always rise over time, making it a valuable commodity and an attractive investment for those seeking financial stability during turbulent times. In the precious metals sector, gold bars are also produced by several reliable mints. The perfect gold bar for your portfolio is available in Bullion Trading LLC’s collection of gold bullion bars at the lowest premium prices.

Generally, gold bars are of two variants, i.e., cast gold bars and mint gold bars. Cast gold bars are manufactured easily with only a refinery logo and stamped as crucial markings for weight, purity, and metal. These bars get poured into prefabricated molds after it is built by melting in a vat.

Both government mints and private refineries produce minted gold bars through refining processes that remove impurities by melting the metal. Afterward, the fine gold will be molded through heat and pressure and stamped with weight, purity, and metal.

Gold bars are not limited to their weight. You will find a great deal of variety when purchasing gold bars for sale. Gold bars are available in a wide range of designs. Some Gold Bars are so popular that they are viewed as a symbol of excellence. The following are some of the popular methods of gold bars available:

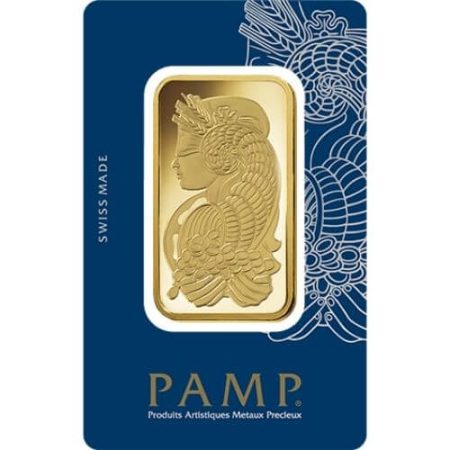

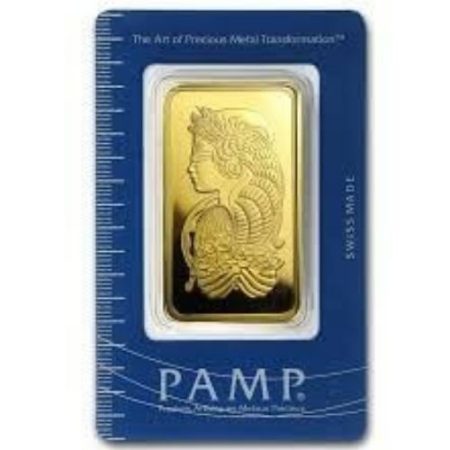

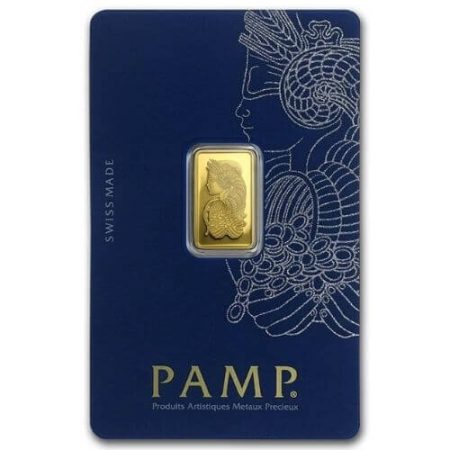

PAMP Suisse Lady Fortuna Gold Bars are unique and beautiful. These bars feature the beautiful Roman Goddess, Lady Fortuna who is believed to be the goddess of Luck and fortune according to Roman mythology. These bars are available in a weight ranging from 1 gram (0.032 Troy oz) and as big as 1 kilogram (32.15 Troy oz) of 99.99% gold content. These bars come in their original packaging with certificate and assay cards that meet international standards for identity authentication, purity identification, and quality assurance.

PAMP Suisse Cast Bars are made from full-cast gold ingots, which undergo an intense refining process to remove impurities such as lead or copper. These bars feature the PAMP logo on the obverse side and the reverse side is intentionally left blank. These bars are usually available in a weight ranging from 50 grams (1.608 Troy oz) and as big as 1 kilogram (32.15 Troy oz) of 99.99% fine gold content. These bars are shipped in original packaging and come with a certificate and assay card that meets international standards for quality assurance, purity identification, and identity authentication.

Pamp is a refinery that produces top-quality gold bars. At the same time, lunar products are built, being inspired by an animal known for the chinese zodiac. Pamp Suisse has limited products representing specific animals which leads to appealing to collectors. These bars contain 99.99% pure gold and are available in different sizes and beautiful designs.

Credit Suisse Gold Bars offer a superior way to diversify your precious metals portfolio. These bars are available in sizes from 1 gram to 1 oz and come with an assay card that certifies the weight, purity, and metal content of each bar. These bars feature the company’s logo, weight, purity, and assayers mark on the obverse whereas featuring the company’s logo in a repeating diagonal pattern on the reverse side.

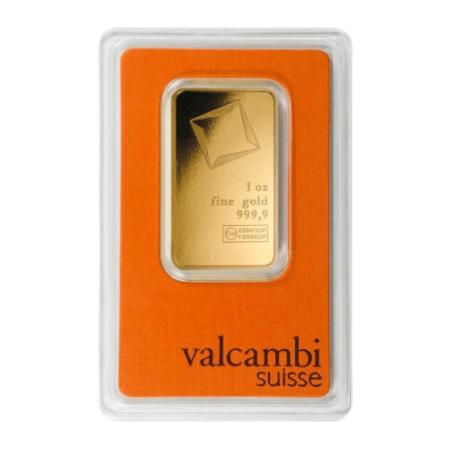

Valcambi Gold Bars are one of the most popular gold bars manufactured in Switzerland. Valcambi bars are usually available weighing from 1 gram to 1 kg and come with a certificate confirming their purity. These bars mostly feature the ‘Valcambi Suisse’ inscription on the obverse side while the reverse side of the bar contains the Valcambi logo, the size, and the purity mark. Gold Bar prices depend on the current spot price of gold and the extra premium that the gold dealer puts as a markup. Gold bar prices change as frequently as the gold spot price.

Metalor Gold Bars are made using traditional European refining methods. The 1 Kilo Metalor Gold Bar is one of the most popular bars of standard size and weight. The Metalor Gold bar is 24karat and has a purity of 99.99%. The pure gold bar is uniquely numbered. You can quickly get resale when you purchase a sizable gold bar from a well-known precious refinery like Metalor. A well-known and respected maker of gold bars is Metalor. Therefore, investors searching for a high return on investment with vast quantities of money might consider buying one kilogram of gold bars.

Gold bullion bars come in a variety of sizes.1 Troy ounce and 10 Troy ounces of Gold Bars are the most preferred size by investors in precious metal markets. However, 1 Kilogram Gold Bars are liked by gold buyers due to the product’s weight and uniqueness, which provides a superior value when you consider the price of gold per ounce in that single 1 Kilogram bar. Some of the famous gold bar weights available at Bullion Trading LLC are as follows:

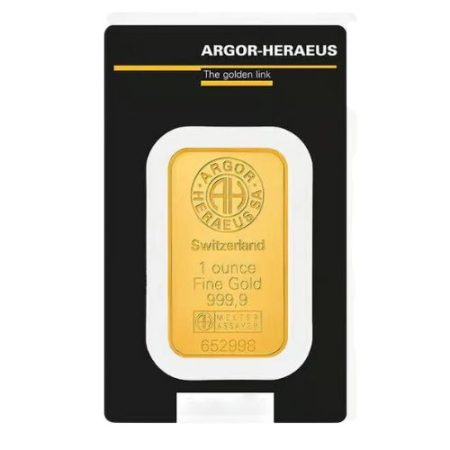

The 1-ounce gold bars are the most popular gold bar sizes that are a great way for new gold buyers or novices looking to invest in gold bullion. Some of the most popular 1 oz gold bars are PAMP Suisse Lady Fortuna, Credit Suisse, and Argor Heraeus Gold Bars.

The 5 oz gold bars are common for long-time investors with sizes that are portable in hand or pocket. They are most popular because of their low prices, and low premiums, and because they are risk-free investments.

10-ounce gold bars are an excellent investment option for both long-term and short-term buyers. It is the best investment option for those who don’t want to deal with fluctuations in the market.

1 gram(0.032 Troy oz) gold bars are as popular as one-ounce bars. This makes them a favorite among investors and entry-level collectors. Fractional gold bullion bars have the highest premiums on precious metal bars.

5 gram (0.16 Troy oz) gold bars offer investors and collectors the ability to buy small ingots at lower prices, making it easier for beginner or casual investors to enter the gold market with less risk involved.

10 grams(0.32 Troy oz ) gold bars are great for both investment and gift options for special occasions such as birthdays, weddings, or anniversaries. It is the perfect size option, combining the most popular 1-kilogram bars with the smaller 1-ounce and 1 gram gold bars.

100 gram(3.22 Troy oz) gold bars are popular among investors and collectors as they are available at lower prices than the spot price. Even though these gold bars are a little bit difficult to trade, they are still the favorite among collectors worldwide.

1 kilogram(32.15 Troy oz) gold bars are the most popular gold bar size as they are available at a lower price than the spot price. These bars are preferred by professionals and experienced investors who are looking for large bars that can be used to melt a variety of metals.

Real Gold is respected on a Global Scale due to its high value and significant history. Whereas they are considered an investment opportunity also they have a lower premium as per their size, purity, and weight. People have held gold over the ages for a variety of reasons. By placing value on gold, the worth has increased by societies and economies. It has some worth as protection against bad times since it is the metal we turn to when other types of money are ineffective. Here are some of the reasons for investing in gold and other gold bullion product right now:

As we know, the global demand for gold is constantly increasing every day, so purchasing gold bars online is undoubtedly one of your best investment choices. As it helps to diversify your portfolio and reduce risk and it is certain that the value of gold will hike even in economic or political uncertainty. As gold is considered a safe investment, it doesn’t matter what happens in the financial market around the world. Investors are also more interested in purchasing gold. Many people now invest in commodities, especially gold. In fact, as of 2019, SPDR Gold Trust was the largest gold bullion holder globally and one of the most significant U.S. exchange-traded funds.

Since ancient times, people have used gold as a store of wealth. It has practical applications in electronics and jewelry, adding even more concrete value. In addition, gold is available in considerably smaller quantities than fiat currency. Due to these factors, gold has traditionally been seen as a haven investment and an inflation hedge.

A gold bar can be added to any precious metals portfolio because it is a tangible asset. You can actually own a gold bar, which gives you more security and confidence in your investment. The market price for the gold bar is independent of other assets such as shares or stocks. If shares of many companies lose value at once, gold bullion bars can be used to offset the loss. This is why it should not fall simultaneously.

Buying gold bullion bars from Bullion Trading LLC is the most cost-effective way for gold investors to buy gold bars. With over 25 years of experience as a reputable bullion dealer, you can trust us to offer gold ingots at the lowest possible price.

Buying gold bars for sale in bulk in order to reduce the price per ounce of gold can save you money every time you purchase a gold bar.

If you have any questions regarding gold bullion bars and gold bullion coins, please contact us at (646-362-3536) and we will be happy to assist you. Bullion Trading LLC is able to sell gold bars and Gold Bullions during normal business hours (Mon-Thu, 8:30 AM to 4 PM EST, Fri 8:30 – 1 PM ET).

Alternatively, Bullion Trading LLC provides the option to buy gold bars online. All orders are processed by Bullion Trading LLC, which guarantees that all transactions are secure and safe with us. We also offer excellent customer service before, during, and after your order has been placed so that we may guarantee an easy transaction for our customers.

Gold Bars are a great investment because gold is not only scarce, but it holds value over time. Gold will continue to rise in price and can be used as collateral against some types of investments. Gold bars also have the advantage that they don’t expose you to inflation risk like paper currency does.

Most of the gold bars are made up of 99.99%(24-karat) fine gold. Some of the African gold bars are made up of 22 karat fine gold. 24 karat gold bars are referred to as pure gold but they are not technically 100% pure gold. 24 Karat gold bars has .001 grams of non-gold material for every kilogram of weight already present when melted down.

Generally, gold bars are made in two distinctive ways i.e cast method and the mint method. The smaller bars are minted. A sheet of gold is stamped, cut, and shaped into the required shape and weight. These minted bars are exceptionally clean with a perfect finish. Larger gold bars are made using a cast method. Ingots are made by pouring molten into molds of a certain size. These have a more natural finish and are usually rougher.

Yes, Gold bars are legal in the United States. Gold Bars can be traded in USA without any special license.

Gold bars are worth their gold content. The gold in a gold bar is priced based on the live spot ounce price of gold and its fineness(e.g., 22k, 24k). The live spot price of gold can fluctuate daily depending on supply and demand trends as well as international market factors.

Yeah, most of the gold bars have the serial number inscribed on their surface which in some cases helps in determining the authenticity of the gold bars. The serial numbers are not the important factor that determines the value of the gold bar. The gold bar’s purity and weight are the only factors that determine their value.

The safest way to buy gold bars is to look for trustworthy gold dealers like Bullion Trading LLC, who are reliable and offer the gold product at the lowest possible price. After making a purchase, keep that gold in the safest place at relevant banks, deposit boxes, or home.

Before investing in gold, you need to analyze the investment goal and risk of the particular products. Investing in physical gold is the best option which has secure high storage. Moreover, gold mutual funds and exchange-traded funds (ETFs) can be a simple method to diversify your portfolio.

In the United States, there is no such limit. You can buy the gold as per your financial statements and investment abilities. More importantly, if you have a massive amount of gold, then it's better to keep it safe, else if you want to buy a small or large amount of gold, look for trustable gold dealers like Bullion Trading LLC.

Generally, you don't have to pay tax if you buy or invest in any precious metals; however, if you make a profit after selling a bullion product, you need to pay tax as per the value.

Gold Bars and Gold Coins are the most accessible types of gold to sell. These bullion products are sold according to their weight, purity, and Market price.

Trading in gold and other precious metals is risky because the market is volatile. Past performance is not indicative of future returns. This is why we encourage you to read Our Terms and Conditions carefully before making purchases, selling, or placing orders with BULLIONTRADING LLC. Refer to Safety Tips from the CFTC (Commodity Future Trading Commission). These terms and conditions apply to all orders, all purchases, and all sales made through our website, telephone, or other channels.

In the event you do not fully understand the terms of this agreement, BULLIONTRADING LLC strongly encourages you to consult with your own experts. BULLION TRADING enters into transactions with customers on the reliance and belief that clients are aware of, understand, and agree to these terms.

These terms and conditions are effective as of March 11, 2022, and are binding to all new and existing customers and users.

The prices for gold, silver, platinum and palladium coins and bars keep on fluctuating because of the risk factors that cause price volatility. The risk factors include political development, war, pandemics, demand, and supply. It is important to keep this in mind when transacting with BULLIONTRADING LLC.

BULLIONTRADING LLC. Does Not speculate on the prices of precious metals. This means that we don’t make profits by buying gold when the prices are low and selling when prices go up. BULLIONTRADING LLC generates revenue through premium spreads. This is the difference between what Bullion Trading LLC pays & sells these items for.

Orders and inquiries can be made through our website, phone, or other suitable channels. Contact Us for information.

Inquiries are made by customers who are not ready to transact immediately. Customers can contact us or go online at Bulliontradingllc.com to get current market prices. The price quote and quantity available are subject to change. They can also contact us for guidance on buying and selling bullion coins and bars. You should note that the Price Quotations you receive when inquiring are Estimates because the prices of bullion coins and bars fluctuate daily, and the number of our stock changes all the time.

For example, The U.S Mint sets premium and minimum prices for American Eagles. Prices for American Eagles are determined by the current price of gold, silver, platinum, or palladium. The mint also charges a modest premium to cater to the cost of distribution and marketing. Consequently, the price of bullion coins and bars changes daily as the markets for gold, silver, platinum, and palladium fluctuates. Refer to the United States Mint’s Charges for Authorized Dealers.

Orders are made when customers are ready to transact immediately. The prices you get when ordering bullion coins and bars from us are an accurate reflection of the current market prices. Note that once you place an order, the prices are locked and are no longer subject to market conditions.

An order is placed when you finalized negotiations with our agents and an invoice is generated, not when the payment is made. Ordering and then bailing out or canceling after an invoice is generated makes BULLIONTRADING LLC incur losses. We incur losses because when you place an order, we consider the bullion coin or bar sold and will have hedged ourselves accordingly.

Disclaimer: To protect our company from losses, BULLIONTRADING LLC has implemented a Market Loss Policy.

An order starts when you finalize the deal with our agents, not when the payment is made. We generate an invoice immediately the deal is sealed either through our website or phone. We also count the bullion coin or bar as sold and will have hedged ourselves accordingly.

Customers who place orders, have invoices generated, and then cancel thereafter make us incur losses. To protect ourselves we have implemented a market loss policy. This means that you will incur penalties for ordering, having an invoice generated, and then bailing out. Once an order is placed, prices are locked and not subject to market conditions.

The moment you place an order an invoice is generated. If you cancel, and then gold prices decline you make us incur a loss. It is your responsibility to offset this loss if your order is canceled and your funds are returned. If this happens you will pay for the loss caused by a decline in the price of gold after a sale is made plus a cancellation fee of $35.00. This is our market loss policy.

To remain transparent and protect ourselves from risk we might require credit card information from every customer even if payment will be received through a different channel. We also will ask for immediate confirmation of the amount locked in. This gives us an avenue to compensate ourselves for losses in the event a customer places an order and then fails to pay.

However, if the price of bullion coins and bars stays the same, we usually don’t enforce our market loss policy because we don’t incur losses. If the price goes down we charge a market loss fee which is equal to the amount BULLIONTRADING LLC would have lost because of the unpaid order.

Bullion Trading LLC only accepts payments in the form of bank transfers, certified checks or personal checks. The method you use to pay us is determined by the number of bullion coins and bars you are willing to buy from us as follows:

If Using A Credit Card You Are Agreeing To The Following Terms:

You agree that you have sufficient experience and knowledge to make informed decisions to purchase from and/or sell to BULLION TRADING LLC. You openly acknowledge that you are making all of your decisions in connection with purchases and/or sales. BULLION TRADING LLC is not making any decision on your behalf concerning purchases and sales.

You also openly acknowledge that you are subject to a variety of risks that are beyond the control of BULLION TRADING LLC. You openly acknowledge that BULLION TRADING LLC is not liable or responsible for the risks you incur while trading with us. Those risks include, without limitation, risks associated with the price volatility of bullion coins and bars. Market conditions or other disruptions such as technical problems may make it impossible for you to liquidate bullion coins and bars bought from us. You have the freedom to liquid the coins and bars at market prices acceptable to you.

All investments involve risk – bullion coins and bars are no exception. The value of bullion coins (e.g., American Eagles or Maple Leafs) is affected by many economic factors. The current market price of bullion coins and bars is determined by perceived scarcity and other factors. Some of these factors include quality, current demand, and general market sentiment.

The price of bullion coins and bars keeps on fluctuating and this means that they are not a suitable investment for everyone. Since all investments, including bullion coins and bars, can decline in value, you should make an informed decision. It is a good idea to have adequate cash reserves and disposable income before investing in bullion coins and bars.

You shall indemnify and absolve BULLION TRADING LLC and its affiliates, directors, officers, and shareholders collectively. You agree to compensate the indemnified parties for and against any costs, damages, expenses, liabilities, and obligations. They include without limitation to reasonable attorney fees that the Indemnified Parties may incur as a result of, or in connection with:

(a) Any breach of any representation or warranty made by you to BULLION TRADING LLC or,

(b) Failure to comply with these terms and conditions or the policies adopted by BULLION TRADING LLC.

You acknowledge that you are subject to the limitations of liability contained in these terms and conditions, the disclaimer, and other policies adopted by BULLION TRADING LLC.

If you suffer indirect, punitive, or speculative damages BULLION TRADING LLC is not liable to you. Any transaction between us and you pursuant to these terms and conditions, and any liability of BULLION TRADING LLC to you shall be limited to:

(a) The amount, if any, that you paid in such transaction or,

(b) $100 compensation. We are not, in any event, liable for any indirect, punitive, or speculative damages.

BULLION TRADING LLC has adopted a Privacy Policy that is included in these terms and conditions. Our privacy policy protects your identity and credit card information.

BULLION TRADING LLC privacy policies are found in the Disclaimer, Ordering Policy, and the protection of credit card information. These terms and conditions may be updated from time to time depending on the market forces and the legal landscape.

Upon any failure by you to comply with your obligations to BULLION TRADING LLC, the company shall pursue the rights and the remedies available to us. Either by law, through equity, or otherwise. It includes without limitation rights and remedies under these terms and conditions.

Breaching our rights may make BULLION TRADING LLC turn your account over to a collection agency, or a lawyer for collection. BULLION TRADING LLC will not fail in exercising any rights or pursuing any remedies in the case we suffer losses or damages.

Note: Failure by you to comply with these terms and conditions, may make BULLION TRADING LLC charge the credit card on which you have provided. This includes without limitation any and all market losses incurred by BULLION TRADING LLC, including cancellation fees, for ordering and then canceling at the last minute. You openly authorize BULLION TRADING LLC to charge your credit card for all losses caused by you violating our ordering policy.

BULLION TRADING LLC is an authorized dealer and a professional organization. We maintain a professional relationship with all our clients. We don’t enter into relationships such as agent-principal relationships, employee-employer relationships, franchisee-franchisor relationships, joint venture relationships, and partnership relationships with our clients.

You cannot forfeit these terms and conditions, your rights, or your obligations as they apply without the prior written consent from BULLION TRADING LLC. You may be granted permission to forfeit your rights or it may be withheld by BULLION TRADING LLC at its sole discretion. These terms and conditions shall be binding to all parties that trade with BULLION TRADING LLC.

If you violate these terms and conditions BULLION TRADING LLC will take action against you. It may include without limitation, turning your account over to a collection agency, or a lawyer for collection. You shall pay all of the costs and the expenses incurred by BULLION TRADING LLC, including without limitation to reasonable attorney’s fees.

BULLION TRADING LLC maintains professional relationships with clients. This is why we make sure that any grievances are resolved expeditiously. We agree that all disagreements and disputes with our clients should be resolved in accordance with the provisions below.

Because we value the relationship with our clients, we opt for arbitration or mediation as a channel for dispute resolution instead of going straight to state/federal courts. However, if arbitration or mediation fails, we may be forced to take legal action in state/federal courts in the State of New York.

These terms and conditions are governed by and interpreted in accordance with the laws of the State of New York. These terms and conditions do not take into consideration the possible violation of laws in other jurisdictions.

BOTH BULLION TRADING LLC AND YOU HEREBY WAIVE THEIR RIGHT TO TRIAL BY JURY IN CONNECTION WITH ANY DISAGREEMENT OR DISPUTE RESULTING FROM, OR IN CONNECTION WITH THESE TERMS AND CONDITIONS; OR THE TRANSACTIONS UNDER THESE TERMS AND CONDITIONS. Both BULLION TRADING LLC and you also waive any arbitration requirements to which they might be subject.

If BULLION TRADING LLC cannot perform any obligation hereunder as a result of any event that is beyond its control, the company shall be excused and shall not be liable for any damages as a result of, or in connection with, such delays, or such failures.

You shall sign and avail other documents, or take actions that assist BULLION TRADING LLC in enforcing the provisions of these terms and conditions.

Except as provided in these terms and conditions, all notices, and other communications to BULLION TRADING LLC shall be directed to it at 20 West 47th Street Lower Level #24, New York, NY 10036. All notices and other communications to you shall be sent by BULLION TRADING LLC, to the address that you provided to us at the time of your registration, or to the email address that you provided to us at the time of your registration.

BULLION TRADING LLC may record phone conversations between you and company agents or representatives. You consent to the recording of such phone conversations.

A decision or a failure by BULLION TRADING LLC to take action with respect to any non-compliance with these terms and conditions does not affect the ability of the company to enforce the terms and conditions with respect to other violations. Whether the violations are similar or dissimilar in nature.